Are you enjoying this blog?

To join our newsletter, text BLOG to (833) 779-2627 or enter your phone number 👉

How to Do Payroll By Yourself | A Complete Guide

If you're a small business owner, you need to run payroll without much hassle. Learn how to do payroll yourself with this article.

Jump To...

How Does Payroll Work? | What Are Your Payroll Options? | Conventional Payroll | Payroll Software Service | Common Challenges Small Businesses Face When It Comes to Payroll | Key Takeaways

Many companies report compliance challenges in payroll, including paying employees on time, keeping up with regulatory compliance, and inaccurate employee source data imported into the system. Managing payroll can be intimidating for a small business owner or self-employed person. It involves everything from calculating employee wages and deducting tax payments, which may not be that straightforward.

While outsourcing payroll to a professional service provider has its benefits, it can be expensive and may not be feasible for small businesses or startups. Fortunately, with some knowledge and preparation, it’s possible to do payroll by yourself.

How Does Payroll Work?

Payroll is the system that ensures employees (or yourself) are paid accurately and on time and that the company stays compliant with tax laws and regulations. But the process involves much more than simply handing out paychecks.

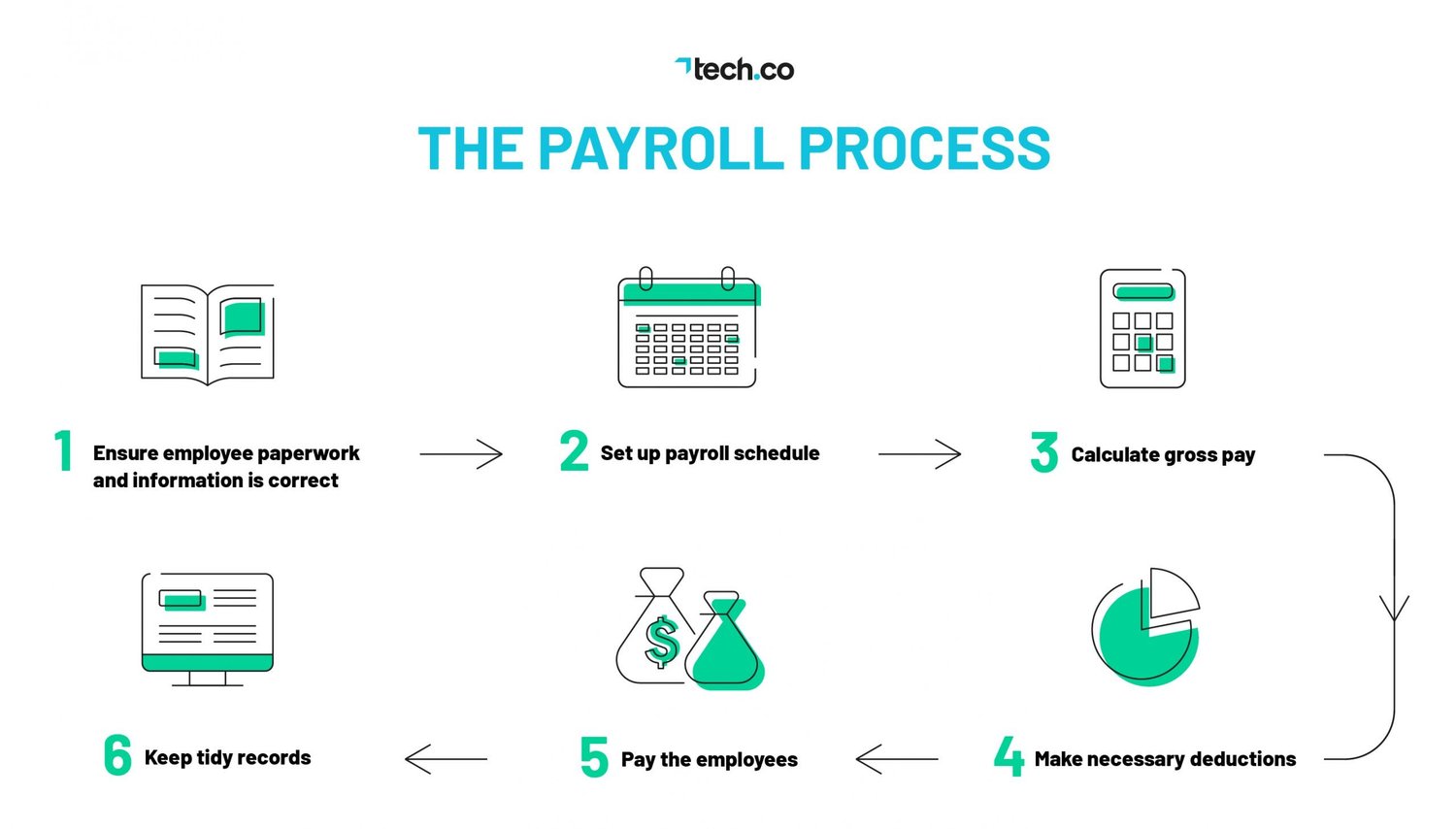

Before payroll can even begin, all paperwork and information should be correct and up to date. Social security numbers, tax withholding preferences, and employment eligibility should all be verified.

Then, you need to set up a payroll schedule that works for your business and/or your employees. Depending on your company structure, this can be weekly, bi-weekly, or monthly,  Source: Tech.co

Source: Tech.co

Next, you'll need to calculate each employee's gross pay, factoring in hours worked, overtime hours, and any bonuses or commissions. From there, you'll make necessary deductions for taxes, Social Security, Medicare, and any other benefits or contributions.

Finally, you'll make payments and keep tidy records of all payroll transactions, including pay stubs, tax forms, and financial reports.

What Are Your Payroll Options?

If you’re a business owner, you’ll know there isn’t just one way to handle your payroll. There are self payroll services, such as online payroll software, as well as hands-off approaches like third-party providers.

Keeping things in-house and managing payroll yourself might seem complex at first, but it can also give you the most control over your payroll process.

Conventional Payroll

In this section, we’ll go through the conventional payroll process that involves tax forms, tax obligations, and more.

Ensure Employees Complete a W-4 or W-9

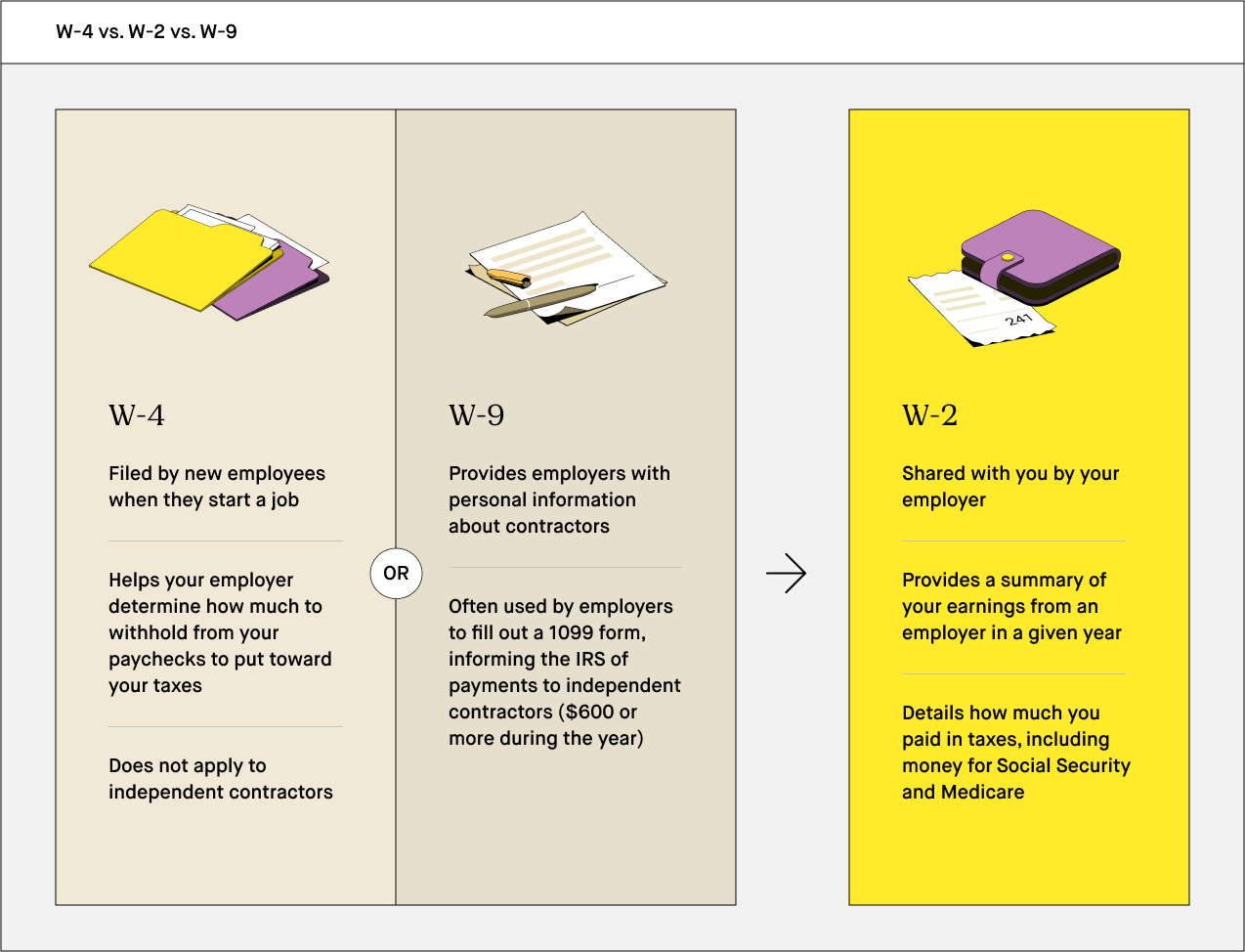

The IRS requires the W-4 and W-9 forms to help figure out how much tax should be withheld from an employee’s paycheck. Source: Robinhood

Source: Robinhood

The W-4 form is used by those considered employees under the tax code, while the W-9 form is used for independent contractors or freelancers. The W-4 simply determines how much the employer needs to withhold from a paycheck to put toward tax payments. The W-9 form gives the employer the contractor’s taxpayer identification number (TIN) or social security number (SSN) so that they can report their earnings to the IRS with a 1099 form.

For example, a home services business that only employs full-time employees will need to have their crews fill out a W-4, while an automotive services business that employs contractors will need them to fill out a W-9.

Register for an Employer Identification Number (EIN)

If you’re not a sole proprietor and your business entity is structured as a partnership and corporation, you require an Employer Identification Number. While sole proprietors tend to use their SSN in place of an EIN, they are still able to register for an EIN to establish independent contractor status or for other reasons.

Registering for an EIN ensures your business is compliant with tax laws and regulations and prevents potential tax penalties or headaches down the line.

Decide How Frequent Payroll Will Be Run (Weekly, Bi-weekly, Semi-weekly, Monthly)

The frequency of your payroll schedule can have a big impact on your cash flow, employee satisfaction, and administrative workload. Employers and business owners typically choose from four payroll frequencies: weekly, bi-weekly, semi-weekly, and monthly.

Weekly payroll can give employees a consistent and timely paycheck, but it can be a time-consuming process. The bi-weekly option strikes more of a balance, while semi-weekly (or bi-monthly) is a great way to stay on top of tax deadlines. Monthly payroll is less frequent and less costly but can be an unpopular, infrequent option, especially for freelancers and contractors.

Determine How Much Income Tax Will Be Withheld

The amount of income tax to withhold depends on several factors, including filing status, withholding allowances, and the employee’s taxable income. Calculating the correct numbers is important to avoid under-withholding (leading to penalties) and over-withholding (employees receiving a small paycheck). Source: QuickBooks

Source: QuickBooks

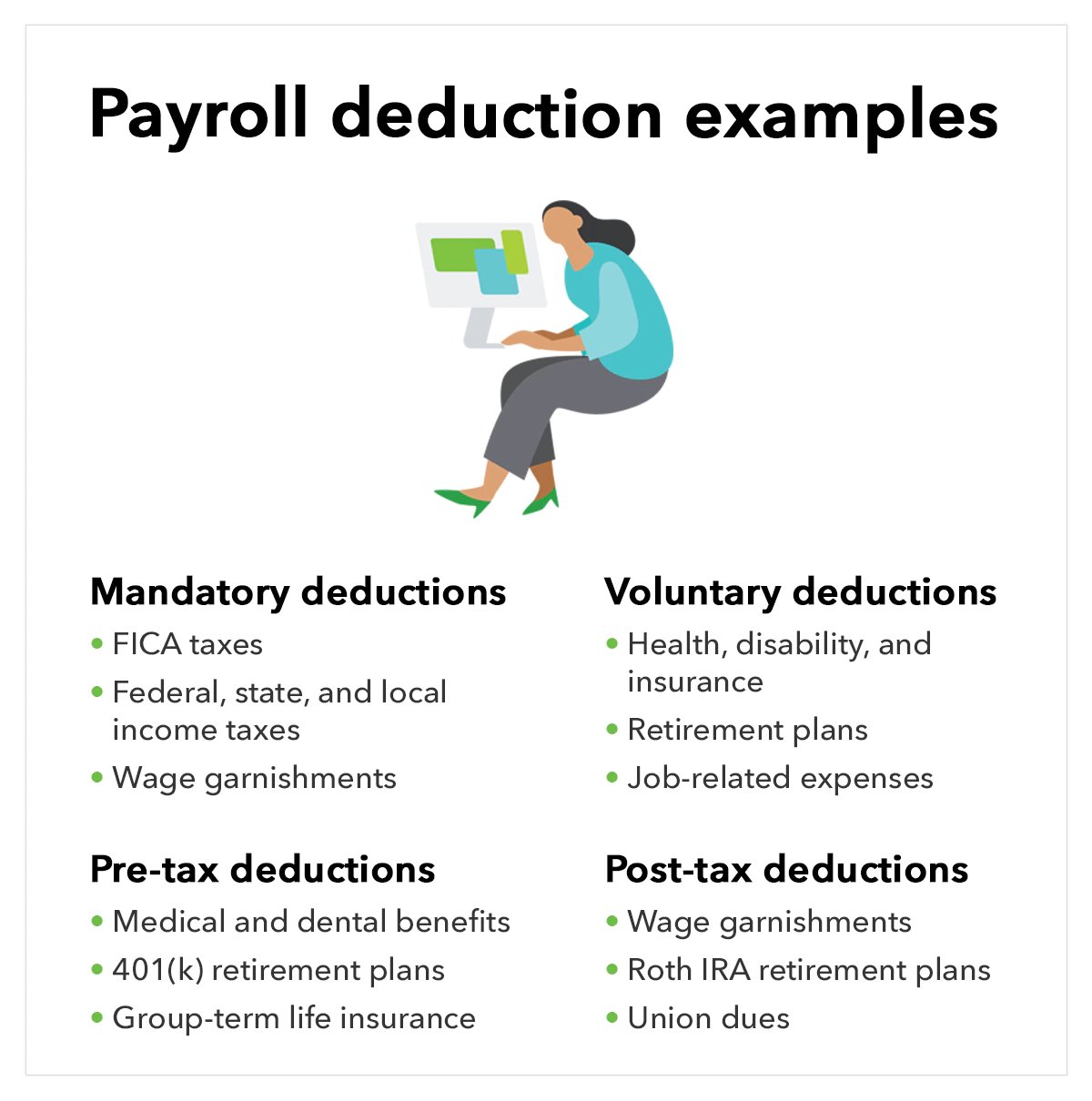

And it’s not just income tax withholding you need to consider. There are also several types of deductions that may also need to be taken into account. Mandatory deductions, such as Medicare and Social Security taxes, are required by law and calculated as a percentage of gross pay. Pre-tax deductions refer to things like health insurance premiums or a 401k retirement plan that can reduce taxable income.

Voluntary deductions, such as job-related expenses, are typically deducted after taxes are calculated but before the employee receives their net pay. Post-tax deductions like wage garnishments are deducted after taxes and after any other deductions are taken out of the net pay.

Review for Any Mistakes

Even the most minor errors in calculators or data entry can lead to significant problems for employers and employees, from missed payments to penalties and fines. Implementing a thorough review process for each payroll run can minimize risk. You might choose to double-check calculations, verify employee data, and confirm all deductions and state and federal taxes are accurately made.

While manual review can be enough in some cases, there are also software tools that can help automate the review process. They can flag potential discrepancies and alert employers before paychecks are sent out.

Process Your Payroll

After you’ve gathered the right forms together and calculated gross pay and other deductions, it’s time to issue a direct deposit or paycheck. Self-employed individuals will be responsible solely for themselves, calculating their own income and expenses, net profit, and paying their own taxes and self-employment taxes.

Report Payroll To Your Tax Agency

No matter whether you’re self-employed or run a small business, reporting your payroll requires filing tax forms and maintaining good bookkeeping practices. This way, you’ll be prepared for audits and be well on top of tax deadlines. Depending on your situation, there are various tax forms, including Form 941 for quarterly tax reporting and Form W-2 for annual wage and tax reporting.

Payroll Software Service

Source: Forbes

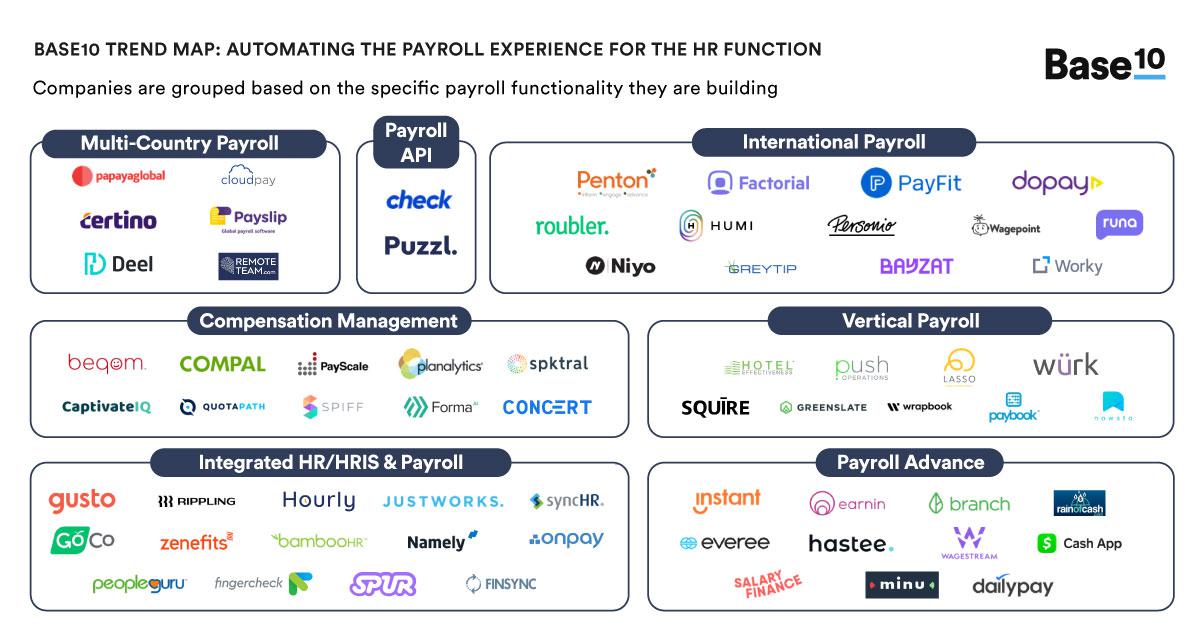

If you’re still unsure about manually handling payroll on your own, online payroll software has a variety of functionalities that can help businesses manage their payroll processes more efficiently. One of the key benefits of this type of software is automation, helping to reduce the risk of errors and save time for both employers and employees.

For example, international payroll software looks to manage payroll processes for employees working in different countries. They specifically look to ensure your business is compliant with tax laws and regulations where your employees are. On the other hand, compensation management software looks to track bonuses and benefits, as well as manage employee time off and leave requests.

Find a Payroll Service Provider That Fits Your Needs and Your Budget

Each payroll service provider is unique and offers different levels of service, pricing, and functionality. While some payroll service providers might have a basic payroll processing service that includes processing payroll, calculating taxes, and preparing tax forms, others might boast more advanced functionalities.

Sole proprietors might only require the basics, whereas those with many employees can certainly benefit from customizable solutions to fit their business needs.

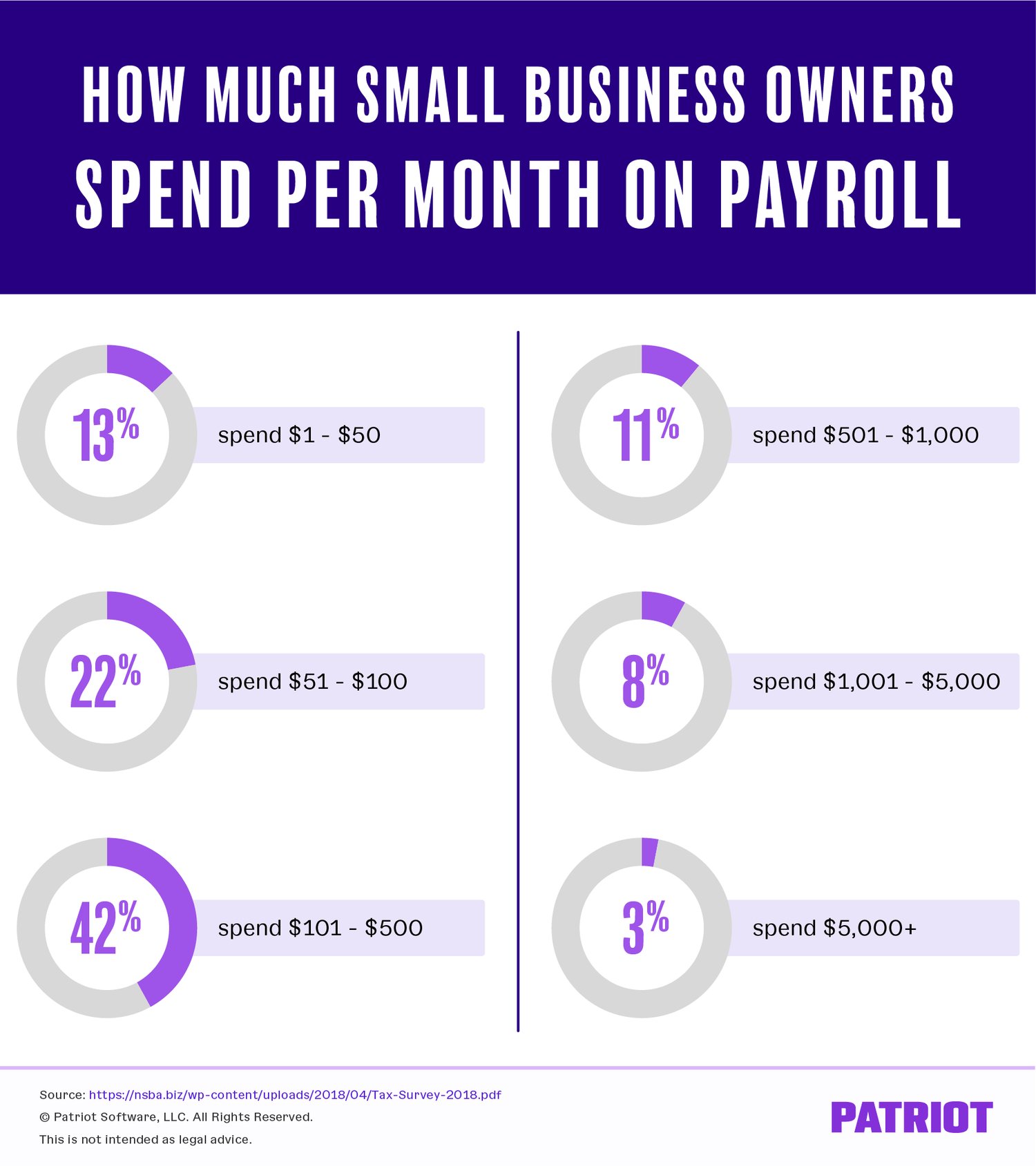

Source: Patriot Software

Payroll software isn’t typically free either, so be sure to account for this when choosing a provider. The majority of small businesses spend between $101 and $500 on payroll, while 22% (the second largest category) spend $51 - $100.

Although this may seem like a significant expense for small businesses, outsourcing payroll can ultimately save money in the long run. They reduce errors, risk of fines, and potentially integrate with other HR systems for seamless data transfer.

Get the Right Business IDs According To Your State and Local Requirements

Business IDs ensure your business is properly registered with the government and that you’re complying with all the relevant requirements. Depending on the state you’re in, the specific IDs will vary. There are a few IDs you’ll need to obtain, but one of the most important is a state tax ID, allowing you to collect and remit sales tax on taxable goods and services. Other IDs might include a state business license, a federal EIN, and a local business license.

Are you enjoying this blog? To join our newsletter, text BLOG to (833) 779-2627.

Add Your Employees To the Service You Choose

After you’ve chosen your respective payroll service provider, you’ll need to add your employees to the system. Most payroll services offer an online portal and/or mobile app where you can easily add and manage employee information. As long as your employee information is kept up-to-date in the payroll system, the payroll process will run smoothly, and you can issue employee wages accurately and on time.

Track and Import the Hours They’ve Worked

Tracking employee hours forms the basis for calculating employee pay and taxes. Luckily, many payroll service providers have an integrated time and attendance tracking system that lets employees clock in and out electronically. This is particularly useful for remote or international employees who wouldn’t be able to physically clock in and out of the office.

Determine Gross Pay, Net Pay, and Payroll Deductions

Gross pay, net pay, and payroll deductions all contribute to the total amount paid out to an employee. Gross pay is the total amount an employee earns before any deductions are taken out, while net pay is the true amount an employee receives after all deductions have been subtracted. Online payroll software can completely automate many of these calculations.

Common Challenges Small Businesses Face When It Comes to Payroll

Every business faces significant challenges when having to deal with employee wages. After all, with so many components to take into consideration, it’s easy to make mistakes.

- Managing different types of employee compensation: Small businesses may have a variety of employees who are paid an hourly rate or are salaried. Calculating the right amount of compensation for each employee type can be challenging, especially when taking things like taxes into account.

- Compliance with tax laws and regulations: Tax laws and regulations are constantly changing year after year, and small businesses may not be accustomed to them.

- Dealing with employee turnover: When employees leave, businesses need to manage the termination process, including calculating final pay and handling unemployment insurance claims.

- Keeping track of employee hours: With fewer employees, small business owners often opt to use manual processes to track employee hours, which can be time-consuming and error-prone.

- Payroll processing errors: Incorrect calculations or missed payments can often happen with payroll processing, leading to potential employee disputes and damage to the business's reputation.

- Employee classification: Businesses that don’t properly classify employees as exempt or non-exempt can face issues when it comes to payroll calculations and potential legal liability.

- Record-keeping and reporting: Poor record-keeping is common among small businesses that are new to handling records of pay rates, tax withholding, and other payroll-related information.

- Budget constraints: Small businesses may have limited resources to invest in payroll processing and may struggle to find affordable payroll solutions that meet their needs.

Key Takeaways

Learning how to do payroll by yourself may seem like navigating a maze at first, but with payroll software and more experience, it can be a beneficial and rewarding process.

To begin, you’ll want to first master the basics of payroll, such as how to calculate gross pay, withhold taxes, and issue paychecks. From there, it's important to establish a consistent process for recording and tracking payroll data, such as using payroll software or spreadsheets.

Other key considerations include staying up-to-date with tax regulations, complying with wage and hour laws, and properly classifying employees. And don’t forget - accuracy is key when it comes to reporting, so always be sure to get those reports in on time.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)