Your Guide to Friendly Payment Reminders: Templates + Timeline

Keep reading for a bulletproof payment reminder timeline and templates to ensure timely payments from your clients.

Jump To...

Your Invoice Process - A Quick Look | What Do I Include In Payment Reminders? | TEMPLATE: One Week Before Due Date | TEMPLATE: Day-Of Due Date | TEMPLATE: Two Days To a Week Overdue | TEMPLATE: Two Weeks Overdue | TEMPLATE: One Month Overdue | TEMPLATE: Thank You Message | Is It Ever a Good Idea to Send a Late Invoice to Collections? | Frequently Asked Questions

Doing what you love for a living can be incredibly fulfilling—especially when you’ve nurtured loyal and trusting relationships with your clients. However, to achieve long-lasting success, you’ll also have to learn how to manage the most unpleasant aspects of running a business. This can include things like accounting, logistics, administration, and asking for overdue payments. You may be wondering how much leeway is appropriate to give your customers to close out their balance, and how many payment reminders are appropriate to send before escalating your request.

Read on for payment reminder etiquette for small businesses, along with a recommended timeline for requesting payments, frequently asked questions, plus six templates to copy and tweak as you see fit.

Does Your Business Need a Website?

Discover the Benefits and Get Started Today!

Your Invoice Process - A Quick Look

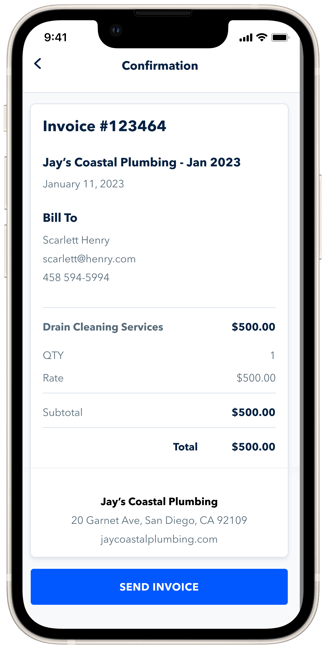

Before we get into payment reminders, let's first ensure that you send regular, complete invoices. When it comes to timely payments, strong invoices a critical first step.

That way, when you go to send reminders, customers are more likely to recognize the expense and pay you right away.

For a more detailed guide on how to create a full-proof invoice system, check out our other blog, What Makes Up an Effective Invoice?

Here are some tips to help you make your payment reminders work better. You can try some or all of them to improve how you do invoicing and payments.

- Introduce formal estimates that require customers to request changes, then approve.

- Have a standard list of services and descriptions that you can add onto your invoice.

- Include all your and the customer's pertinent information, such as address, names, and contact information.

- Draft and send invoices electronically (mobile invoices are ideal).

- Make it easy to pay you by offering contactless payments and secure bank transfers.

It's possible to do all of the above yourself or in Quickbooks at no additional cost. If you're growing fast and need more efficiency in your invoice and payment process, GoSite Invoicing and Payments do all of these tasks for you in just a few clicks and swipes. Source: GoSite Invoices

Source: GoSite Invoices

What Do I Include In Payment Reminders?

There are some items you always want to include in a reminder and some optional pieces of information you can add depending on your relationship with your clients and contracts.

Your payment reminder should always include:

- Company name

- Company contact information

- Total balance

- Due date

- An attached invoice

Optional items:

- Late fees or interest

- Read receipts

- Accepted payment methods

One Week Before Due Date

When creating your payment reminder timeline, it’s important to be proactive. Sending a friendly reminder email or text for your clients five to seven days before the due date is common courtesy and will give them some time to ask any questions they may have on the invoice.

It’s best practice to provide a detailed invoice as soon as the service is completed. However, it’s also a good idea to reattach the invoice for easy access in all of your follow-up emails.

In this reminder, you want to be succinct and friendly. Their payment isn’t due or past-due yet, so use it as an opportunity to thank them for their business and as a subtle way to let them know you’ll be expecting payment soon.

One Week Before Template

|

Subject line: COMPANY NAME - Invoice #0000 due [DATE] Body: Hi CLIENT NAME, Thanks again for trusting us to/with CUSTOM. It was a pleasure doing business with you. This is just a friendly reminder that your balance of $XX.XX is due next week on [DATE]. For your convenience, I reattached your itemized invoice here [LINK]. Please take a moment to review the invoice and feel free to reach out to me if you have any questions or concerns. Warm regards, [YOUR NAME] [COMPANY PHONE NUMBER] [COMPANY EMAIL] |

Day-Of Due Date

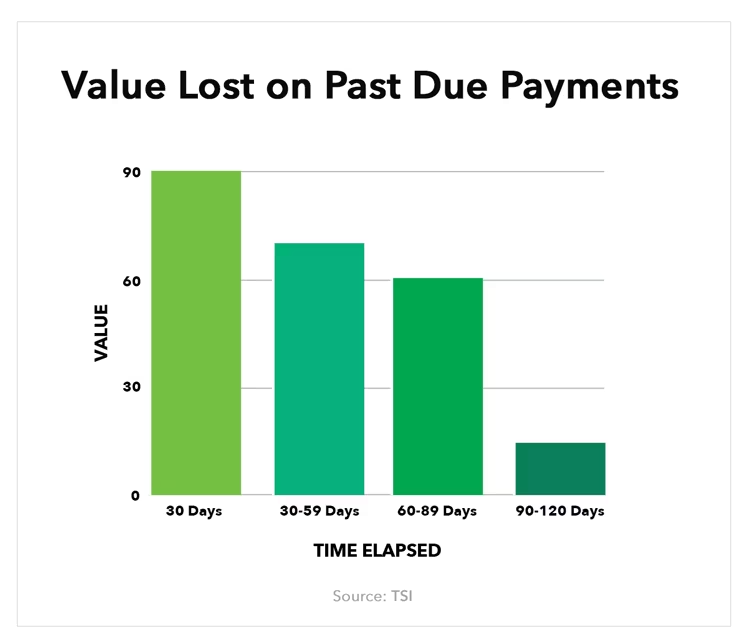

Next, you’ll want to schedule an early morning email or text on the date the invoice is due. If you charge interest or late fees, be sure to include a cut-off time, if appropriate.

Source: TSI & QuickBooks

Source: TSI & QuickBooks

In this communication, you still want to be polite and friendly but include a clear call-to-action to close out their balance by the end of the day. You can also remind them of any payment methods you accept to make it easier for your clients to pay.

Day Of Template

|

Subject line: COMPANY NAME - Invoice #0000 due today Body: Hi CLIENT NAME, I hope you’re doing well. I know you’re busy, so I wanted to send a friendly reminder that a payment of $XX.XX is due by [TIME] today to close out your balance. For your convenience, I’ve reattached your invoice here [LINK]. We accept payments via:

Please feel free to reach out to me if you have any questions or concerns. Warm regards, [YOUR NAME] [COMPANY PHONE NUMBER] [COMPANY EMAIL] |

Two Days To a Week Overdue

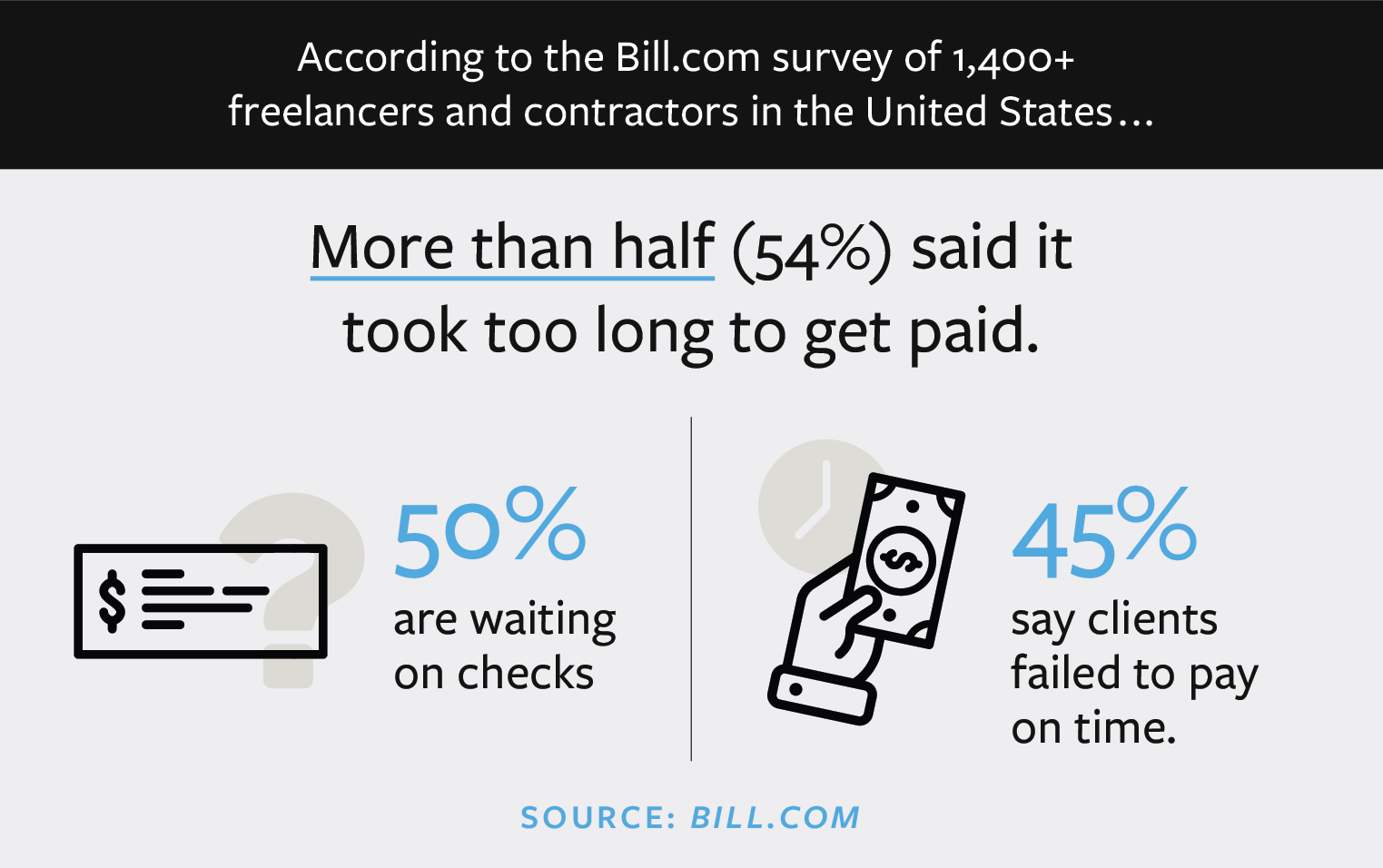

Depending on your relationship with your clients, you’ll want to send another reminder between two days to a week after their bill is past due. Perhaps you have a client who’s a notorious late payer, but they eventually pay in full. If that’s the case, giving them the full extra week after the due date will be a more effective approach.

In this email or text, you’ll want to be a bit more direct but the tone is up to your discretion. Our recommendation is to be polite but use the client’s history, circumstances, and level of communication with you (or lack of) to guide your approach.

Source: Bill.com & Media Silo

Source: Bill.com & Media Silo

Two Days After Due Date Template

|

Subject line: COMPANY NAME - Past Due Invoice #0000 Body: Hi CLIENT NAME, I’m reaching out because our records show that you have a past due balance of $XX.XX, which was due by [DATE]. For your convenience, I’ve reattached your invoice here [LINK]. As a reminder, we accept payments via:

I’d appreciate a text or an email to let me know when I should expect to receive payment or if you have any questions about your invoice. Regards, [YOUR NAME] [COMPANY PHONE NUMBER] [COMPANY EMAIL] |

Two Weeks Overdue

After two weeks of not receiving a payment from a client, you’ll want to add a level of urgency to your communications. You can do this by adding a read receipt to the email or asking for one within the copy of your message.

If they haven’t responded to any of your messages, you should consider reminding them about any late fees or interest they have or will accrue if they don’t submit payment. These terms should’ve been included in the original contract signed by both you and the client.

Two Weeks Overdue Template

|

Subject line: COMPANY NAME - Second Notice of Past Due Invoice #0000 Body: Hi CLIENT NAME, I’m reaching out because our records show that you have a past due balance of $XX.XX which was due by [DATE]. I kindly request that you close out your balance as soon as possible. Per our agreement, a late fee of $XX.XX will be applied to your total if payment is not received by [DATE]. For your convenience, I’ve reattached your invoice here [LINK]. Could you please reply to let me know that you’ve read this email? Thank you, [YOUR NAME] [COMPANY PHONE NUMBER] [COMPANY EMAIL] |

One Month Overdue

Receiving a client’s payment between two weeks to a month late could potentially be affecting your cash flow. If you haven’t received any response from your client at this point, you’ll want to be stern and clearly communicate any next steps you will be taking to collect payment.

However, you still want to keep a professional tone. Your client could’ve changed emails, your emails may be going to spam, or they could be handling an emergency. These things are important to consider especially during a time of crisis like COVID-19. After this message, be sure to give them a follow-up call and include the term “final notice” in all of your written and voice communications.

One Month Overdue Template

|

Subject line: COMPANY NAME - Final Notice of Past Due Invoice #0000 Body: Hi CLIENT NAME, I still have not received payment for your past due balance of $XX.XX. As of today, your bill is [NUMBER] days late. I kindly ask that you close out your balance immediately. If I don’t hear back from you by [DATE], I will have to escalate this matter to collect payment. For your convenience, I’ve reattached your invoice here [LINK]. As always, please reach out to me with any questions or concerns. Regards, [YOUR NAME] [COMPANY PHONE NUMBER] [COMPANY EMAIL] |

Thank You Message

Each time you receive a payment, it’s recommended you send a follow-up “thank you” message to your clients. This will help nurture your relationships, encourage timely payments in the future, confirm receipt of payment, and give you an opportunity to ask for a review. However, before asking for a review, make sure the customer is fully satisfied with your services.

Thank You Template

|

Subject line: COMPANY NAME - Thank You For Your Payment of Invoice #0000 Body: Hi CLIENT NAME, Hope you’re having a great week. I just wanted to let you know that your payment of $XX.XX has been received. This invoice is now closed. I’d like to kindly ask you for a review on [SITE/LINK]. As a small business, reviews help us get the word out there and continue to service valued customers like you. Thanks again for your business and hope to work with you again soon. Warm regards, [YOUR NAME] [COMPANY PHONE NUMBER] [COMPANY EMAIL] |

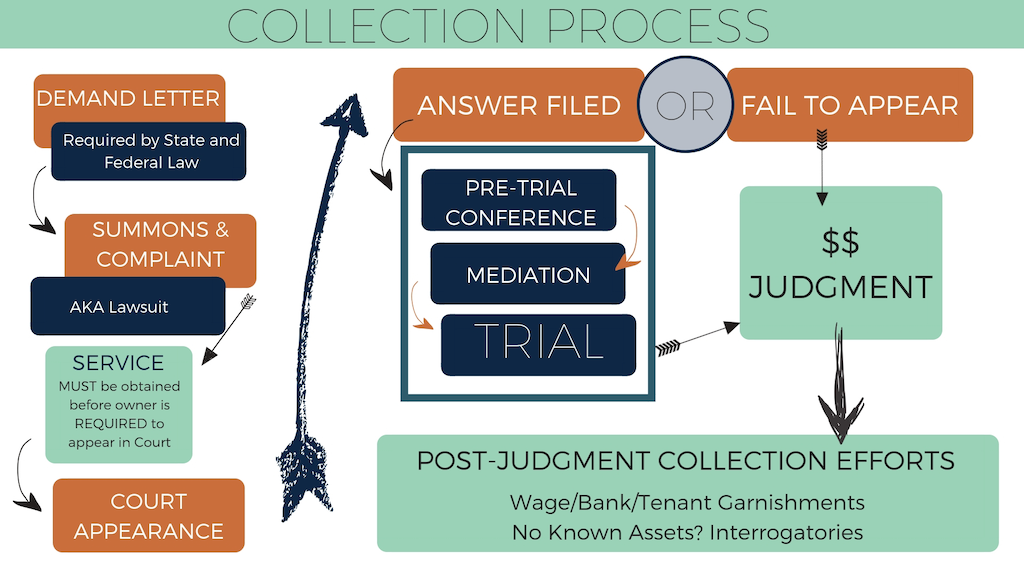

Is It Ever a Good Idea to Send a Late Invoice to Collections?

As a small business owner, you should avoid sending invoices to collections unless it's your last option. Here are some tips to keep in mind:

- Talk to your client about payment terms and deadlines, and send reminders before considering collections. Again, a strong invoice process takes care of this for you.

- Give your clients a reasonable amount of time to pay their invoices, usually around 7 to 45 days.

- Keep records of all communication and documents related to the invoice and payment requests.

- Try to collect payment before considering collections, like sending reminders or trying to resolve any disputes.

- Know the laws and regulations in your area about collections.

- Only send invoices to collections as a last resort because it can be time-consuming, costly, and may harm your relationship with the client.

- If you need help, seek advice from a collections agency, attorney, or financial advisor.

Source: Cornerstone Law Firm

Remember, every situation is different, so it's important to think things through before sending invoices to collections. And always keep good communication and records with your clients.

Frequently Asked Questions

Below are some frequently asked questions small business owners have when requesting payments from their clients.

When should I send a payment reminder?

Similar to our recommended timeline above, it’s best to send your first payment reminder a week before the due date. That way you’ll keep the payment fresh in your client’s mind and give them ample time to look over the invoice.

The number of reminders you send will depend on your relationship with your client. However, sending another reminder on the due date and the following week, if you have yet to receive the payment, is recommended.

How long should I wait before using a collections agency?

Within your accounts receivable strategy, you should establish how long you’re willing to give your clients before contacting a collections agency. If you have good communication with your clients, a 90-day limit could be the most effective approach.

Your messages within those 90 days should be direct and varied in channel. Try a combination of email, text, phone calls, and mail as more time passes.

Once the balance is past due over 90 days, use the amount owed to help you determine whether a collections agency is worth your time and money. Be sure to let the client know you’ll be pursuing additional action to collect payment. Messages like these can be enough to motivate your clients to submit payment—saving you the hassle of using a collections agency or pursuing legal action.

How do I prevent late payments?

If you’re having trouble with late payments, here are a few easy steps you can implement to incentivize your clients:

- Set clear payment terms in your client contracts

- Add any interest or fees for late payments

- Accept various forms of payment including credit cards and text-to-pay

- Consider instant invoicing

- Set automated payment reminders

So whether you’re sending text, email, or letters to your clients, these tips and timeline above will help you send clear and direct reminders to minimize late payments.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)