How To Build Pro Forma Statements for Your Home Services Business

Learn how to create accurate pro forma financial statements for your home services business and make informed decisions for growth and success.

Jump To...

What Are Pro Forma Financial Statements? | Are Home Services Businesses Profitable? | How To Create a Pro Forma Statement | Pro Forma Statement Examples for Home Services Businesses | Key Takeaways for Effective Pro Forma Financial Planning

Pro forma statements are financial documents that provide a forecast of your expected revenues and expenses and are used to analyze their future performance, set goals, and make decisions about investments and resources.

For home services businesses, pro forma statements are vital because they can help you plan for the upcoming season’s budget and anticipate future sales trends.

With the help of this article, you'll be ready to build your own pro forma statements for your home services business, with plenty of examples to show you exactly what the best statements look like.

What Are Pro Forma Financial Statements?

A pro forma financial statement is a document that estimates a company’s future performance. It includes projections about revenues, expenses, cash flow, and other metrics for the upcoming period.

The information in these statements can be used to make decisions regarding money and supplies. They provide valuable insight into how much money you may need to take out of your own pocket versus relying on external investors, which is why home service businesses tend to use them.

They also allow home businesses to anticipate what their budget will look like in the upcoming season and plan for potential sales trends or changes in demand.

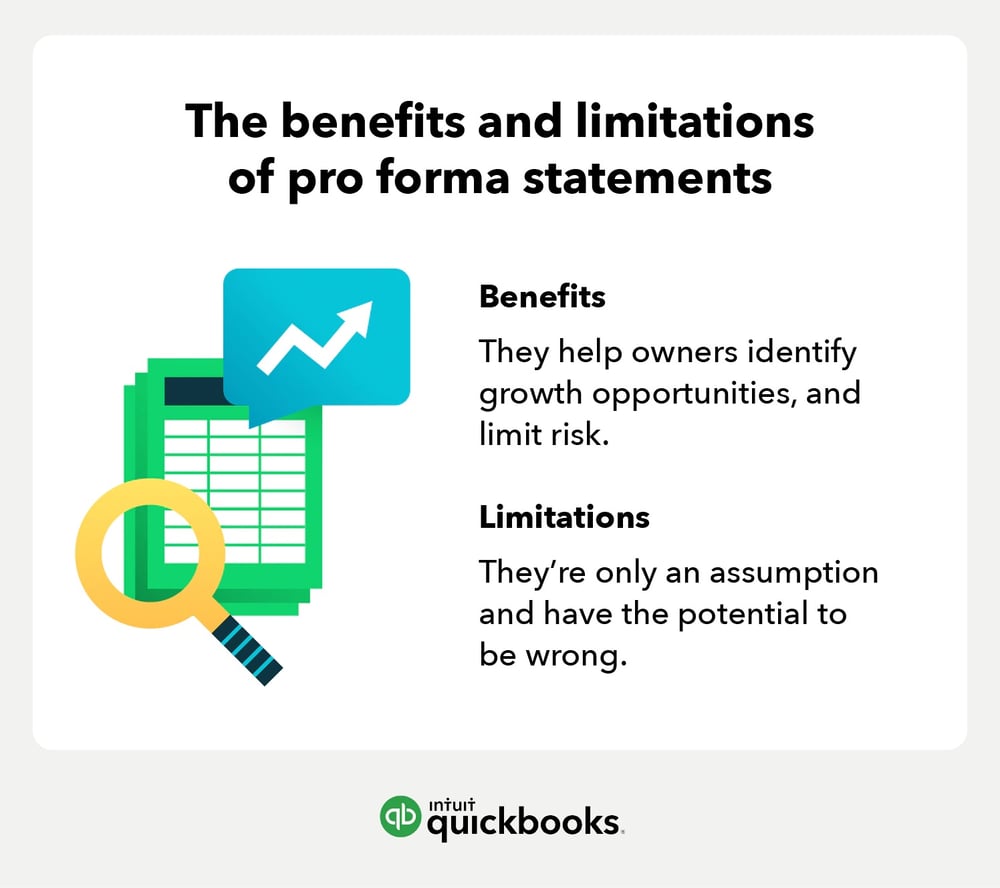

Source: QuickBooks

As seen in the image above, pro forma statements have limitations. While they are often a reasonable estimate of what will be most profitable for a business, they are only an estimate and do not reflect how the market may change in the near future.

This is why it is vital to monitor your statements over time to make sure you are staying on track and not relying on pro forma statements completely.

Common Pro Forma Terms and Their Definitions

- Pro Forma: A document used to forecast future performance, typically based on past financial information or industry averages

- COGS: Cost of goods sold; the direct cost associated with producing a product or providing a service

- Depreciation: A non-cash expense that reduces the value of an item over time, usually something that is useful to your business

- Operating vs. Non-operating Expenses: Necessary expenses to keep a business running, including salaries and rent vs. additional costs incurred that are not essential for the day-to-day operations of a business, like interest payments on debt or investments in research and development projects

- Interest Expense: The cost of borrowing money from a lender, such as processing fees and interest costs

- Asset: Any tangible item owned by a company that has value, like tools, vehicles, and office supplies

- Liabilities: Money owed to another person or lender, such as a loan or line of credit

- Current vs. Non-current Assets: Assets that are expected to be used up or sold within a year, like inventory vs. assets held for longer than one year

- Current vs. Non-current Liabilities: Money owed that is due within the year vs. money owed that will be paid in more than one year

- Working Capital: The monetary difference between a company’s current assets and liabilities; a measure of financial health

Are Home Services Businesses Profitable?

Home services businesses are extremely profitable, especially in the current job market. According to a survey conducted by the National Association of Home Builders in 2023, 80% of home builders are experiencing a shortage of labor.

Additionally, a great deal of the population will be considered senior citizens (over 65) in less than 40 years, which means the supply and demand of home laborers will be very unbalanced, as most seniors are unable to complete their own home maintenance projects anymore.

Due to unfair wages from large corporations, tradespeople usually get much higher wages if they go into business themselves. According to Zippia, the median wage for tradespeople is currently $38,236 a year, but in different states and under different employers, the rate can increase to over $50,000 in the U.S.

By contrast, home, auto, and skilled service professionals are able to generate three or four times that amount as self-employed (particularly where industry licenses and certifications are required).

Profitability Changes Over Time

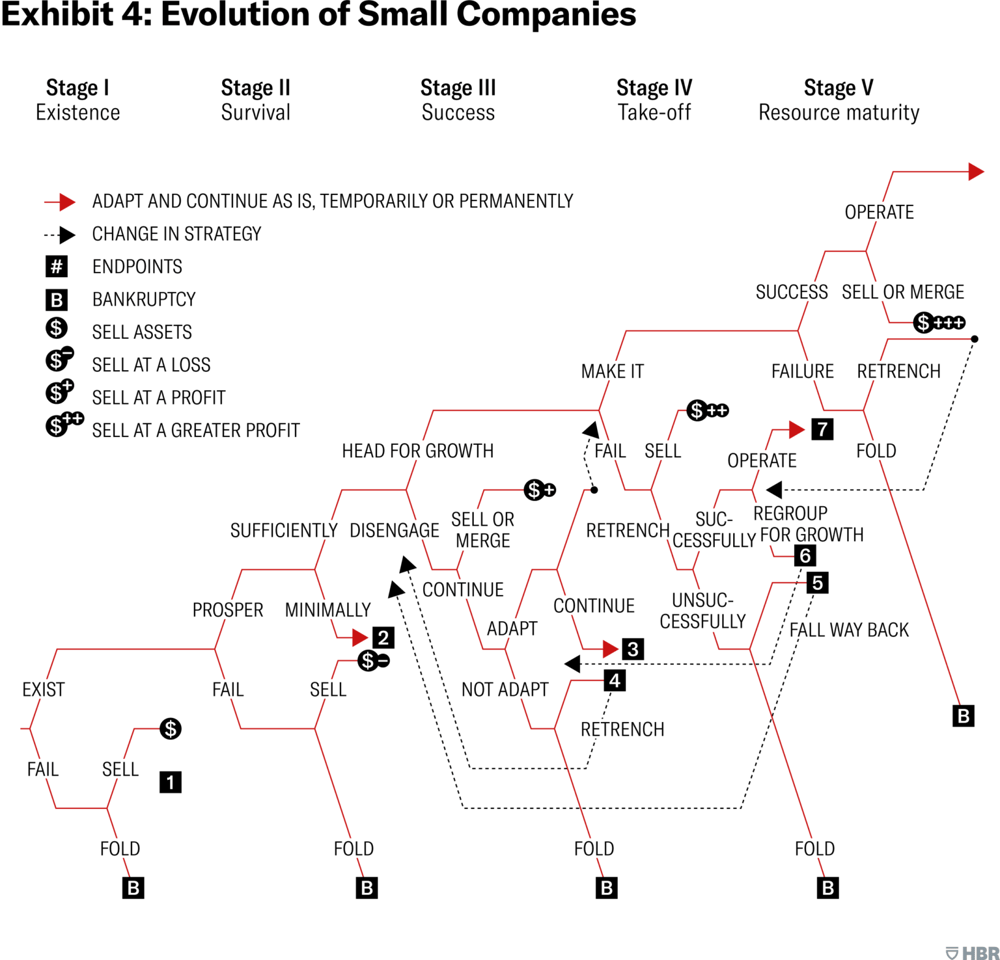

Source: Harvard Business Review

As demonstrated in exhibit 4, there are five stages of a small company's evolution: existence, survival, success, take-off, and resource maturity.

The first two stages, existence and survival, are focused on getting the business up and running. In these early stages, you'll need to focus mainly on developing your services and creating a customer base. Once you've established yourself in the market, then it's time to move onto the success stage where you can start setting goals for future growth.

Take-off is when your business starts gaining traction; this is when pro forma statements become particularly important as they provide insight into how much money you should invest to further your growth.

And finally, resource maturity is all about using the resources available to maximize profits while ensuring operations are running smoothly.

All these stages have their ups and downs, but pro forma statements will help you navigate the rollercoaster of success and ensure you make it to that very last stage.

Home Services Businesses in the United States with Highest Demand (as of 2023)

Currently, these ten industries are in extremely high demand. In many parts of the U.S., supply is limited. More importantly, these home services businesses tend to enjoy high profit margins.

- Home cleaning

- HVAC repair

- Electrician

- Plumbing

- Salon and beauty treatments

- Painting

- Lawn care

- Window cleaning

- Pest control

- Handyman

Home Services Business in the United States with Lowest Demand (as of 2023)

Taking into consideration current demand and potential profitability, these ten industries are not what they used to be.

- Furniture repair

- Upholstery cleaning

- Rug cleaning

- Mattress cleaning

- Air duct cleaning

- Water damage restoration

- Mold remediation

- Fire damage restoration

- Flood damage restoration

- Sewage backup restoration

Biggest Costs to Starting a Home Services Business (Most Common)

Before we dive into the specifics of pro forma statements, it’s important to understand what some of the biggest costs are for starting a home services business, as these costs will be reflected in your statement. The most common division of costs is as follows:- Labor: 30-50% of business revenue

- Supplies: 10-20% of business revenue

- Marketing: 5-10% of business revenue

- Insurance: 5-10% of business revenue

- Office expenses: 5-10% of business revenue

- Vehicle expenses: 5-10% of business revenue

- Technology: 2-5% of business revenue

- Professional fees: 2-5% of business revenue

- Travel: 2-5% of business revenue

- Training: 1-2% of business revenue

How To Create a Pro Forma Statement

Creating a pro forma statement requires careful planning and research. It’s critical to understand how each of your expenses will affect your bottom line and what kind of income you can expect from different service offerings. You should also consider any seasonal changes or fluctuations that could impact your profits. Here are some steps to help you get started.

Determine the Type of Statement You're Looking To Create

Pro forma statements come in many forms. You can create one for your overall business, or for specific services you offer. For home services businesses, the most commonly used types are cash flow pro formas and income statement pro formas, but let's take a quick look at the three types to help you determine which is right for you.

Pro Forma Income Statements

- What is it? A forecast of your expected revenue and expenses for the coming year(s)

- What is it for? Analyzing your current financial performance; planning future expenses and budgeting decisions

Pro Forma Balance Sheets

- What is it? A forecast of your assets and liabilities for the coming year(s)

- What is it for? Understanding your current financial position; planning future investments and resources

Pro Forma Cash Flow Statements

- What is it? A forecast of expected cash flowing in and out of your business in the coming year(s)

- What is it for? Analyzing your current liquidity; planning future investments and resources

Gather Historical Financial Data

Finding reliable information to help you estimate your costs and sales is not easy. You’re going to have to do some digging, starting with simple Google searches and then consulting industry-specific publications.That said, Angi Research recently released a report entitled “ The Economy of Everything Home 2022.” We at GoSite highly recommend this resource as a starting point.

From there, you’ll need to consult local data on demand for home improvement/renovations, as well as get an idea of the real estate market. Depending on your industry and services, you may be more likely to cater to new homeowners, home sellers, or long-time homeowners looking to spruce up their home.

Lastly, talk to knowledgeable people in your area, such as:

- Local accountants

- Seasoned real estate brokers and agents

- Potential customers

Estimate Expenses and Costs

One of the most important steps is to identify and estimate all of your expected expenses, including labor costs, materials, overhead expenses (including rent and utilities), marketing expenses, travel costs, etc.

You must be as accurate as possible to get a realistic picture of the future, and you should account for current trends and proven statistics, like this:

According to a report by Angi Research, home services operating costs typically increase 10% each year on average since 2020.

By using research like this, you can estimate your home services business expenses for the upcoming season more accurately and allocate your funds accordingly.

For example, one could research home service operating costs of different companies from the past year, find the average, and allocate funding equivalent to that cost plus 10% for the next year.

Project Revenue for Your Home Services Business

Just like you need to estimate expenses, it's important to forecast the expected revenue for your home services business. This includes not only your income from regularly scheduled services but also any additional sources of income such as one-time jobs or discounts offered during peak seasons.

In addition, you should consider the impact of seasonal changes on customer demand and prices. For example, if customers tend to call more often during summer months due to increased maintenance needs, then you may want to allocate extra funds for marketing or personnel costs that can help meet that higher demand.

In general, however, you should look at yearly statistics to get a good baseline to plan for, just like you should have done for expenses and costs.

According to the same report by Angi Research, home services sales have increased an average of 12% each year since 2020.

Using this data, you can plan for the expected revenue from your home services business and allocate resources accordingly, the same way you did for expenses and costs, using research and a bit of math to get a solid estimate.

Performing Sensitivity Analysis and Scenario Planning

This step involves calculating the various possible outcomes based on different scenarios or assumptions. For example, you could look at how changes in fuel prices might affect your profits if you provide a home heating service. You can also use this approach to determine how additional services or marketing efforts may impact sales over time.

To do sensitivity analysis and scenario planning, you’ll need to gather data on the costs associated with each service, expected sales volume, and profit margins. It helps to create a spreadsheet that tracks all of these variables so you can easily make changes and compare different scenarios.

Monitor and Update Your Financial Statements

Once you’ve created a pro forma statement, it’s important to review and update it regularly. As your business grows or changes, so too should the assumptions in your pro forma statement.

Keep an eye out for new services that could be added to your portfolio, as well as any potential risks or opportunities that may arise from external factors such as economic conditions or customer trends.

It can also be helpful to compare actual results with the projections made in your pro forma statement. This will give you greater insight into how accurate the statement is and what adjustments need to be made going forward.

Pro Forma Statement Examples for Home Services Businesses

One Year Income Statement

| 2023 Pro Forma Statement (USD) for Fictional Cleaning Business | |||

| Residential Cleaning Revenue | 200,000 | ||

| Commercial Cleaning Revenue | 100,000 | ||

| Special Services Revenue | 50, 000 | ||

| Total Revenue | 350,000 | ||

| Cost of Goods Sold (COGS) | |||

| Cleaning Supplies | 20,000 | ||

| Cleaning Equipment Depreciation | 10, 000 | ||

| Labor Costs | 150, 000 | ||

| Total COGS | 180, 000 | ||

| Gross Profit | 170, 000 | ||

| Operating Expenses | |||

| Rent & Utilities | 25,000 | ||

| Marketing | 20, 000 | ||

| Insurance | 10, 000 | ||

| Office Supplies | 5, 000 | ||

| Other Operating Expenses | 10, 000 | ||

| Total Operating Expenses | 70, 000 | ||

| Operating Profit | 100,000 | ||

| Non-Operating Expenses | |||

| Interest Expense | 5,000 | ||

| Total Non-Operating Expenses | 5,000 | ||

| Bottom Line | |||

| Net Profit Before Taxes | 95,000 | ||

| Taxes (30%) | 28,500 | ||

| Net Profit After Taxes | 66,500 | ||

Three Year Income Statement

| Pro Forma Statement for Fictional Cleaning Business | 2023 (USD) | 2024 (USD) | 2023 (USD) | |

| Revenue | ||||

| Residential Cleaning Revenue | 200, 000 | 220, 000 | 242, 000 | |

| Commercial Cleaning Revenue | 100, 000 | 110, 000 | 121, 000 | |

| Special Services Revenue | 50, 000 | 55, 000 | 60, 500 | |

| Total Revenue | 350, 000 | 385, 000 | 423, 500 | |

| Cost of Goods Sold (COGS) | ||||

| Cleaning Supplies | 20,000 | |||

| Cleaning Equipment Depreciation | 10, 000 | |||

| Labor Costs | 150, 000 | |||

| Total COGS | 180, 000 | |||

| Gross Profit | 170, 000 | |||

| Operating Expenses | ||||

| Rent & Utilities | 25,000 | |||

| Marketing | 20, 000 | |||

| Insurance | 10, 000 | |||

| Office Supplies | 5, 000 | |||

| Other Operating Expenses | 10, 000 | |||

| Total Operating Expenses | 70, 000 | |||

| Operating Profit | 100,000 | |||

| Non-Operating Expenses | ||||

| Interest Expense | 5,000 | |||

| Total Non-Operating Expenses | 5,000 | |||

| Bottom Line | ||||

| Net Profit Before Taxes | 95,000 | |||

| Taxes (30%) | 28,500 | |||

| Net Profit After Taxes | 66,500 | |||

One Year Balance Sheet

| 2023 Pro Forma Balance Sheet (USD) for a Fictional HVAC Company | ||||

|

Assets |

||||

| Current Assets | ||||

| Cash | 50,000 | |||

| Accounts Receivable | 100,000 | |||

| Inventory | 75,000 | |||

| Total Current Assets | 225,000 | |||

| Non-Current Assets | ||||

| Property, Plant & Equipment | 200,000 | |||

| Less: Accumulated Depreciation | 50,000 | |||

| Net Property, Plant & Equipment | 150, 000 | |||

| Total Non-Current Assets | 150,000 | |||

| Total Assets | 375,000 | |||

| Liabilities | ||||

| Current Liabilities | ||||

| Accounts Payable | 60, 000 | |||

| Accrued Expenses | 20, 000 | |||

| Total Current Liabilities | 80, 000 | |||

| Non-Current Liabilities | ||||

| Long-Term Debt | 50,000 | |||

| Total Non-Current Liabilities | 50, 000 | |||

| Total Liabilities | 130, 000 | |||

| Equity | ||||

| Shareholder Stock (Partner Investments) | 100, 000 | |||

| Retained Earnings | 145, 000 | |||

| Total Equity | 245, 000 | |||

| Bottom Line | ||||

| Total Liabilities and Equity | 375,000 | |||

Three-Year Balance Sheet

| Pro Forma Balance Sheet (USD) for a Fictional HVAC Company | 2023 (USD) | 2024 (USD) | 2025 (USD) | |

|

Assets |

||||

| Current Assets | 225,000 | 236,250 | 248,063 | |

| Non-Current Assets | ||||

| Property, Plant & Equipment | 200, 000 | 200, 000 | 200,000 | |

| Less: Accumulated Depreciation | 50,000 | 70,000 | 90,000 | |

| Net Property, Plant & Equipment | 150, 000 | 130, 000 | 110, 000 | |

| Total Non-Current Assets | 150,000 | 130,000 | 110,000 | |

| Total Assets | 375,000 | 366,250 | 358,063 | |

| Liabilities | ||||

| Current Liabilities | 80,000 | 82,400 | 84,872 | |

| Non-Current Liabilities | 50,000 | 51,500 | 53,045 | |

| Total Liabilities | 130,000 | 133,900 | 137,917 | |

| Equity | ||||

| Common Stock | 100,000 | 100,000 | 100,000 | |

| Retained Earnings | 145,000 | 257,075 | 366,728 | |

| Total Equity | 245,000 | 232,350 | 220,146 | |

| Total Liabilities and Equity | 375,000 | 366,250 | 358,063 | |

One-Year Cash Flow Statement

| 2023 Pro Forma Cash Flow (USD) for a Fictional Landscaping Company | ||||

|

Cash Flow from Operating Activities |

||||

| Net Income | 120,000 | |||

| Adjustments to reconcile net income | ||||

| Depreciation | 10, 000 | |||

| Changes in Working Capital | ||||

| Accounts Receivable | -20,000 | |||

| Inventory | -10,000 | |||

| Accounts Payable | 15,000 | |||

| Accrued Expenses | 5,000 | |||

| Net Cash Provided by Operations | 120,000 | |||

| Cash Flow from Investing Activities | ||||

| Purchases of Property & Equipment | -50,000 | |||

| Net Cash Used in Investing | -50,000 | |||

| Cash Flow from Financing Activities | ||||

| Proceeds from Loan | 50,000 | |||

| Repayment of Loan | -10,000 | |||

| Net Cash Provided by Financing | 40,000 | |||

| Net Increase in Cash | 110,000 | |||

| Beginning Cash Balance | 40,000 | |||

| Ending Cash Balance | 150,000 | |||

Three Year Cash Flow Statement

| Pro Forma Cash Flow (USD) for a Fictional Landscaping Company | 2023 (USD) | 2024 (USD) | 2025 (USD) | |

|

Cash Flow from Operating Activities |

||||

| Net Income | 120,000 | 132,000 | 145,200 | |

| Adjustments to reconcile net income | ||||

| Depreciation | 10, 000 | 10, 000 | 10, 000 | |

| Changes in Working Capital | ||||

| Accounts Receivable | -20,000 | -20,000 | -20,000 | |

| Inventory | -10,000 | -10,000 | -10,000 | |

| Accounts Payable | 15,000 | 15,000 | 15,000 | |

| Accrued Expenses | 5,000 | 5,000 | 5,000 | |

| Net Cash Provided by Operations | 120,000 | 120,000 | 120,000 | |

| Cash Flow from Investing Activities | ||||

| Purchases of Property & Equipment | -50,000 | -50,000 | -50,000 | |

| Net Cash Used in Investing | -50,000 | -50,000 | -50,000 | |

| Cash Flow from Financing Activities | ||||

| Proceeds from Loan | 50,000 | 50,000 | 50,000 | |

| Repayment of Loan | -10,000 | -10,000 | -10,000 | |

| Net Cash Provided by Financing | 40,000 | 40,000 | 40,000 | |

| Net Increase in Cash | 110,000 | 122,000 | 135,200 | |

| Beginning Cash Balance | 40,000 | 150,000 | 272,000 | |

| Ending Cash Balance | 150,000 | 272,000 | 407,200 | |

Key Takeaways for Effective Pro Forma Financial Planning

Pro forma statements are essential for home services businesses to plan and prepare for the future. By performing sensitivity analysis and scenario planning, monitoring financial results, and regularly updating your pro forma statement, you’ll be better equipped to make informed decisions about investments and resources.

With this knowledge in hand, you can start building effective pro forma statements today and help ensure that your home services business is as successful as possible!

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)