Sending an Invoice: The Foolproof Way to Get Paid Faster

Sending professional invoices gets you paid faster. Here's how.

The bane of any business owner’s existence: Getting paid on time and keeping track of every transaction. No one wants to chase customers down for payments, and no one wants money to slip through the cracks.

The simplest solution? Sending clear and professional invoices.

There are so many affordable invoice software solutions available today, that it’s the best way to keep your payments in order. Being able to create, send, and track all of your invoices online in one place takes the stress out of bookkeeping, saving you time and sanity.

However, there are some best practices to keep in mind when sending invoices. Below, we go through what those are to help you keep a steady cash flow and a good relationship with your clients.

Appearance

Sending your clients professional-looking invoices is a low-effort way of inspiring trust and future business. Having a clean layout with your company logo is important, but ensuring you have the complete and correct information goes a long way in contributing to a positive professional appearance.

Make sure you include:

- Accurate dates – date of service provided, invoice issue date, payment due date

- Complete company details – full business name, contact information, accepted methods of payment

- Purchase Order Number

- Itemized charges with specific details

- Correct total

Pro Tip: If you’re sending the invoice by email, send it as its own email and use a clear subject line. Too commonly, invoices get lost in inboxes.

Timing

Many small business owners are hesitant to send invoices in advance of completing the job. However, if you wait until after the job, you risk disrupting your cash flow or worse—forgetting to send it.

Sending an invoice before or after a job both have their pros and cons, and it ultimately depends on the type of service your business offers and your relationship with your customer.

A third alternative is instant invoicing. For businesses in the home service industry, send your client the invoice immediately after completion of the job while it’s fresh on both of your minds. Otherwise, with the right software, you can automate your invoices in advance. Just make sure you discuss the terms of payment ahead of time, so there are no surprises.

Clarity

You probably know payment amounts should be agreed upon well in advance, but you should treat terms of payment the same way.

Payment terms should be established at the time of booking to ensure alignment with your customer. Whether it’s “net 30 days,” “60,” “90,” or “due upon receipt,” make that clear to the customer in advance and make sure it’s feasible. Likewise, make sure your customer knows what payment methods you do and do not accept in advance, so you don’t run into a problem down the line.

When it comes time for sending an invoice, the payment terms and accepted methods should be clearly stated on the invoice itself (typically at the bottom).

Ease and Accessibility

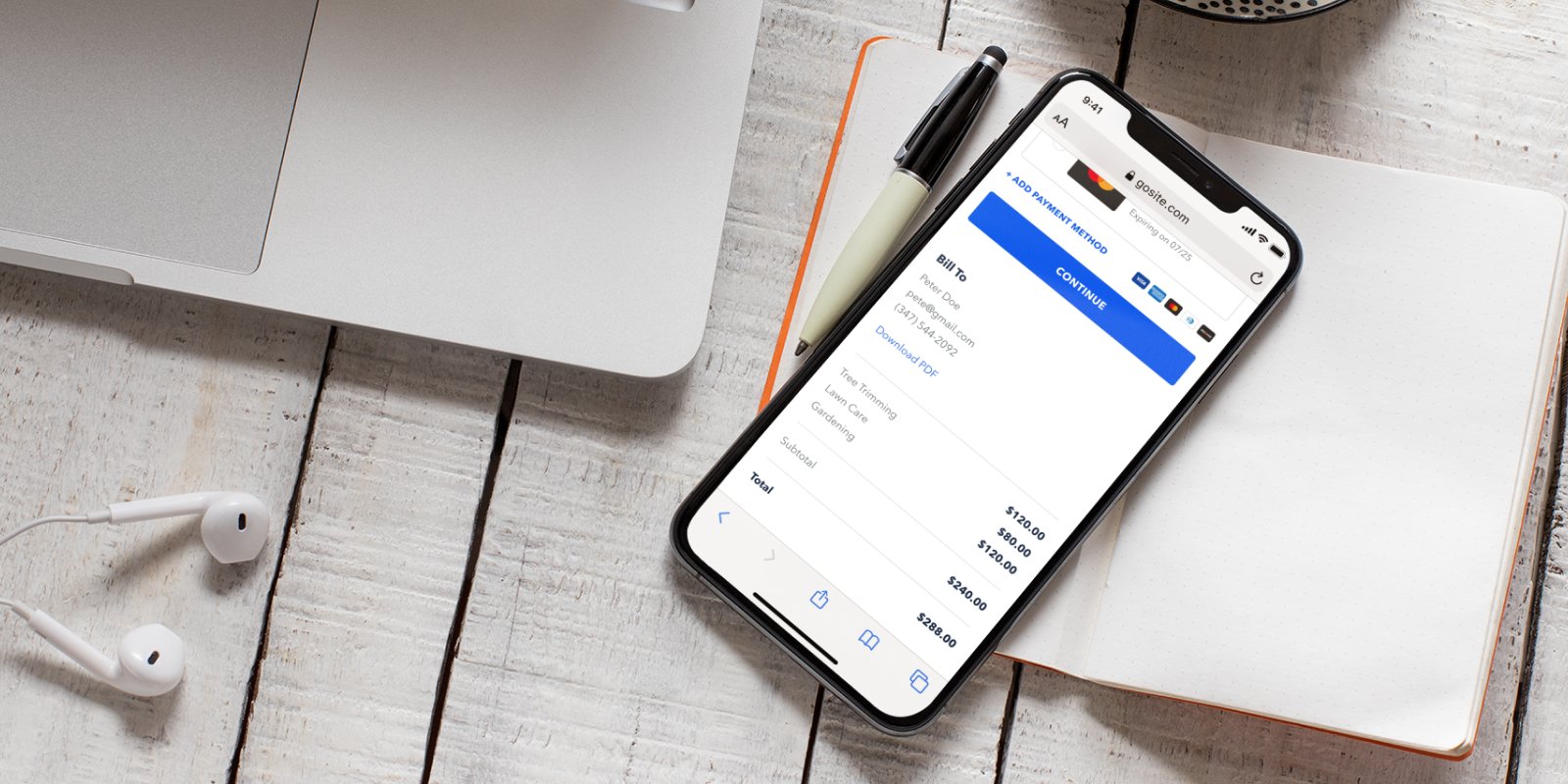

Number one way to speed up cash flow? Accept credit cards. The easier it is for your customers to pay you, the faster they will. Offering online payment options is the way to go.

These days, there are a million and one ways to pay for things. And by giving the customer multiple ways to pay online—desktop, mobile, text-to-pay—you’ll leave little room for untimely payments.

Being able to access and pay an invoice in multiple ways and on multiple devices is going to result in quicker payments and higher levels of customer satisfaction. Since we live in a world where our phones are usually glued to our bodies, customers love mobile-first payment processing.

Automation

Time equals money, right? Well, save yourself some time and automate your invoices. (Especially if they’re reoccurring.)

But while you’re at it, automate your invoice follow-ups too. It’s all too common for late invoices to turn into unpaid invoices without proper follow-ups. Like, very common. One study cited in Entrepreneur estimated that unpaid invoices across all U.S. small businesses amount to approximately $825 billion – aka the equivalent to about 5% of the U.S. GDP – averaging out to $84,000 in unpaid invoices per small business.

What automated follow-ups should you be set up?

-

Upcoming Payment Reminder – There’s no need to wait until after an invoice is due to send a reminder. Depending on your payment terms, send a friendly payment reminder 3, 7, or 14 days before its due date to help your customer remember to pay without being too invasive.

-

Overdue Payment Reminder – Unfortunately, late payments are inevitable but chasing customers down is a time-suck. Set up sequential reminders after the due date to remind your customer it’s time to pay.

-

Payment Confirmation – After you get paid, send your customers an automated follow-up email to thank them for their payment. (Pro Tip: Use this opportunity to ask them for a review.)

Integration

You know what’s even easier than automated invoice software? Automated invoice software that’s integrated with your website, contact hub, messenger, reviews, and payment processing.

Having an all-in-one platform will help keep you organized, save you time, grow your bottom line, and increase customer trust and satisfaction. (We happen to know of a small business apps.)

Having everything in one place streamlines your ability to clearly communicate your service offerings, answer questions, align expectations, deliver quality, and collect payment. Good communication is key for strong customer relationships, and strong customer relationships are key for growing your business.

Invoices are ultimately a very simple way to be more efficient with your business operations. You can experience the life-changing magic of easy, streamlined invoicing yourself with our free trial.

Already use GoSite? Check out this video for a reminder on how to easily send an invoice from our all-in-one platform.

Happy Invoicing!

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)