Are you enjoying this blog?

To join our newsletter, text BLOG to (833) 779-2627 or enter your phone number 👉

Top Financial Statement Creation Tools for Small Businesses

Discover the best tools for creating accurate and professional financial statements, to help you manage your finances effectively.

Jump To...

The Underlying Benefits of Financial Tools | Comprehensive Accounting Software for Businesses | Invoice and Payment Tools for Small Businesses | Spreadsheet Applications for Financial Processes | Key Components of Financial Statements | Enhance Your Financial Health With the Right Tools

Do you ever find yourself tangled in a web of numbers when trying to sort out your small business expenses?

For many entrepreneurs, managing financial statements can feel like quite a task. In fact, the number one reason for new business failures is running out of cash. But, with the right tools at your disposal, you can easily get organized and keep your business on the right track. We’ve compiled the top financial management tools for you here - all specifically designed for small businesses.

The Underlying Benefits of Financial Tools

Financial tools play a key role in the success of any business. They provide a whole host of benefits that can transform the way a small business handles its financial systems. Here are a couple of benefits of these tools for your business:

- Better Organization: Financial tools make it easier to keep track of all your transactions in one place, helping to keep your records neat and accurate all while saving you time.

- Smart Planning: You’ll get valuable insights into your financial performance, so you can make better decisions in the future when it comes to investments, growth strategies, and where to put your resources.

- Improved Communication: When working with investors, suppliers, or service providers, financial tools help present your business's financial data in a professional way that’s easy to understand. This transparency will promote trust and confidence when partnering with others.

- Compliance: Many financial tools are designed to meet legal and regulatory standards, so you’ll rest easy knowing all your financial reports and statements comply with the necessary requirements.

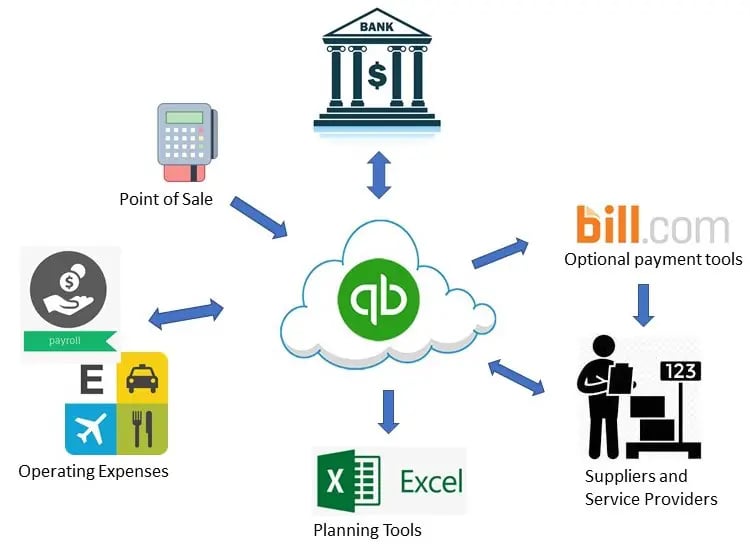

Source: America’s SBDC Virginia Central

Each tool comes with its own unique set of advantages tailored to boost various aspects of your business's financial management. From payroll processing to strategic planning, these powerful tools serve to make business processes a lot less complicated.

Comprehensive Accounting Software for Businesses

In this section, we’ll go over a few accounting tools and the features that these valuable solutions offer. From managing expenses and payroll to generating useful reports, you’ll be able to meet your financial goals much easier.

QuickBooks: Most Popular Business Accounting Solution

QuickBooks is a big name in the accounting world as a fantastic solution for businesses of all sizes, particularly small businesses. Its wide array of features includes everything from invoicing and expense tracking to inventory management and payroll processing.

What makes QuickBooks especially appealing is its user-friendly interface, which simplifies complex financial tasks for people with little to no accounting experience. Its cloud-based platform (an online space where all your files and software are stored) also makes collaboration a breeze between business owners and their accounting teams, making sure the financial data is always up-to-date.

Xero: User-friendly Cloud-Based Accounting

Xero is often mentioned as a powerful, cloud-based accounting software alongside QuickBooks. If you’re not yet ready for the functionalities that QuickBooks offers, you can take advantage of Xero’s minimalist, clean interface that is even simpler to navigate than QuickBooks. They also offer over 800 integration options for business owners to connect with lots of different applications.

Another major advantage of Xero for small businesses is its affordable pricing plans. Their starter price is only $9/month, and their premium plan is $29/month, so if your business is looking to scale, it’ll remain an affordable solution.

FreshBooks: Designed for Freelancers and Small Businesses

FreshBooks boasts an easy-to-understand structure for freelancers and small businesses, which is why it's a favorite. While it has features like invoicing, expense tracking, and time tracking, what sets it apart from many tools like Xero and QuickBooks is its primary focus on invoicing and time tracking features, making it a perfect fit for service-based, blue-collar professionals.

While it does cover accounting necessities, its range of features is not as wide as Xero or QuickBooks. This narrower focus makes it a more straightforward solution for handling invoicing and basic bookkeeping.

Zoho Books: Integrating Financial Management in the Zoho Ecosystem

Zoho Books stands out for its integration within the Zoho ecosystem. This particularly benefits those who are already invested in Zoho's suite of products, such as Zoho CRM, Zoho Projects, or Zoho Inventory, as it provides an all-in-one platform for managing many aspects of their business.

Another unique feature is Zoho Books' client portal which enables efficient communication and collaboration with clients, such as sharing invoices, estimates, and project details.

Invoice and Payment Tools for Small Businesses

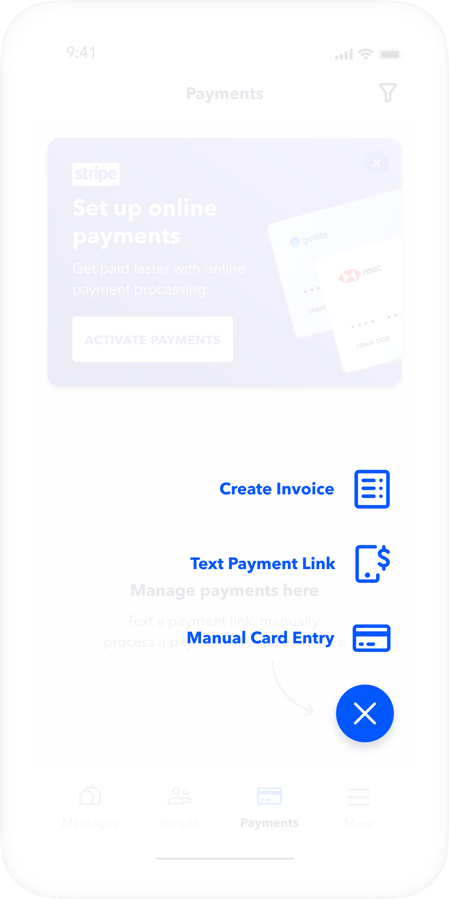

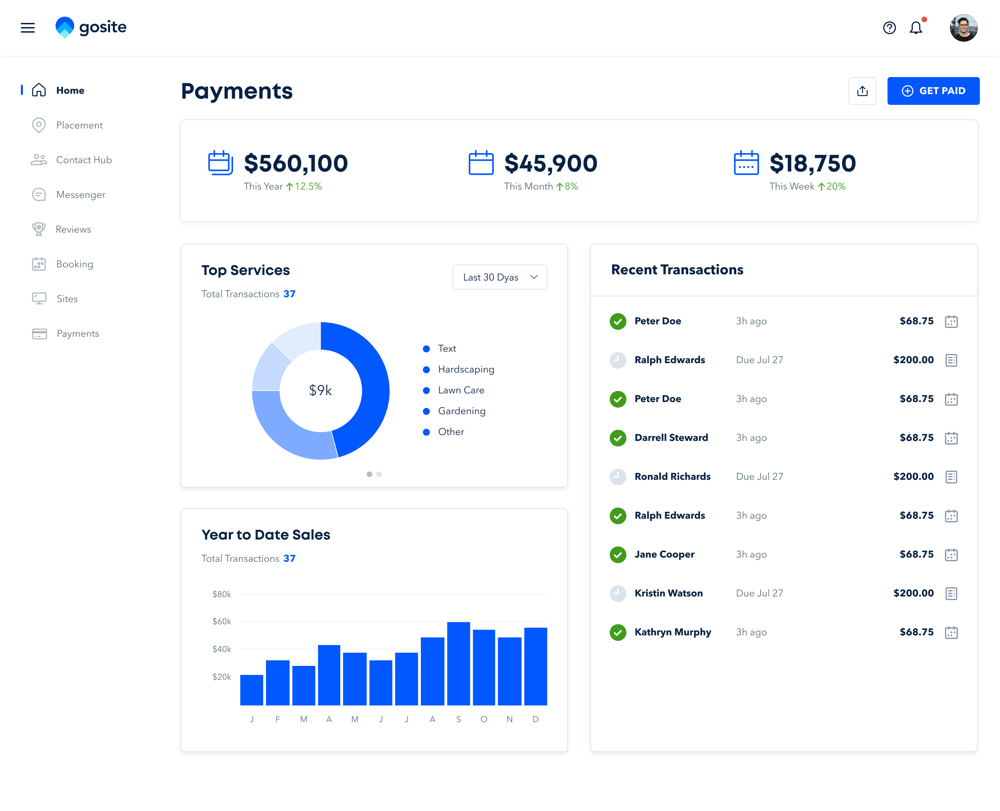

GoSite is a simple modern payment and invoice solution for owner-operators designed to make running your small businesses a lot easier. You can get found, get more business, and get paid on time. While GoSite doesn’t generate formal financial statements, it does integrate with QuickBooks so that business owners can still effectively manage their financial records.

Source: GoSite

GoSite's invoicing and payment features are accessible through mobile devices, enabling business owners to create professional invoices on the go. This flexibility is big for small businesses and blue-collar workers who need prompt invoicing and payment solutions. The platform also offers an innovative text-to-pay capability for faster customer payments, which is essential for keeping a healthy cash flow. Studies show 35% of customers will pay through text message, but only 4% of small businesses offer the option to.

Source: GoSite

With GoSite, small business owners can also access basic sales growth data, helping them track how well their business is performing over time. This airtight invoicing process makes GoSite one of the best expense tracking tools out there.

Want help improving cash flow for your local business? We can help. Text GOSITE to (833) 779-2627 to learn more.

Spreadsheet Applications for Financial Processes

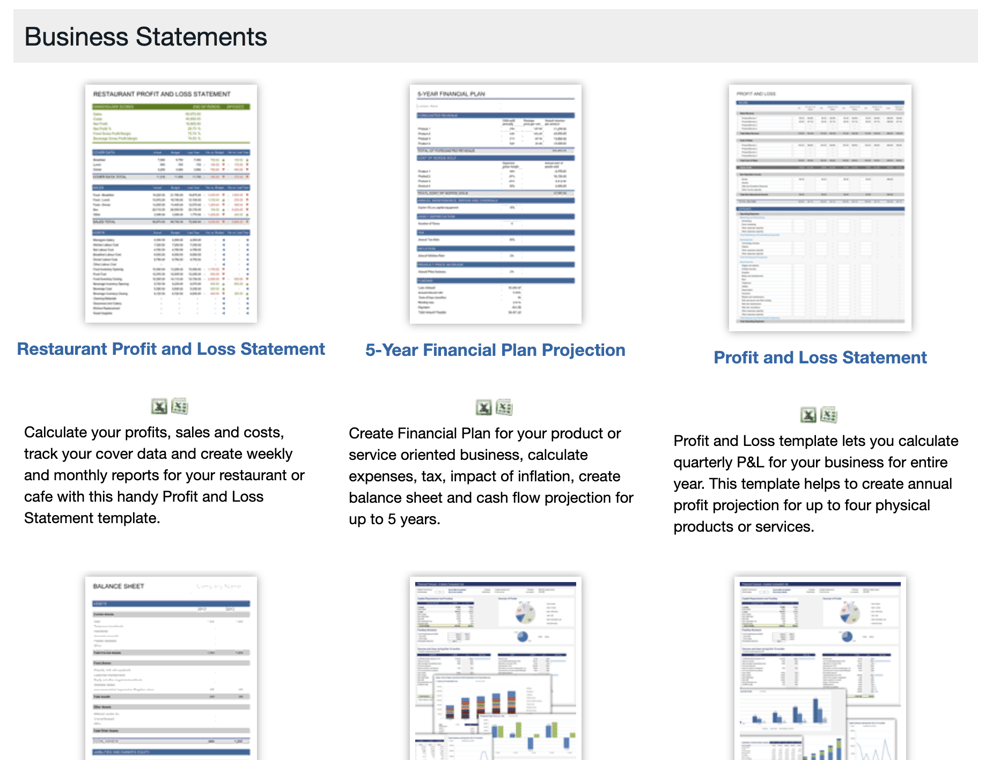

Microsoft Excel: Customizable and Versatile Financial Analysis

Microsoft Excel is the ultimate spreadsheet application, thanks to its customizability and versatility in handling financial analysis. Excel's powerful features, such as PivotTables, charts, and built-in functions, provide small business owners with a free toolkit to manage anything from simple calculations to more complex statistical analyses.

Source: Smartsheet123

One key advantage of Microsoft Excel is the availability of numerous third-party templates created both by professionals and the global user community. These ready-made templates (such as the examples shown above, courtesy of Smartsheet123), such as profit and loss statements, cash flow projections, and detailed financial plan projections, work to make financial tasks seamless and save time and effort.

Google Sheets: Collaborative and Cloud-based Financial Management

Google Sheets is popular for businesses seeking a cloud-based and collaborative approach to financial management. As a part of the Google Workspace suite, Google Sheets uses the power of the cloud for real-time collaboration.

On the platform, there are many built-in templates like income statement templates, which simplify the process of generating professional financial statements for small businesses. These templates promote consistency and accuracy in financial reporting while saving time and resources that can be allocated towards other tasks.

Key Components of Financial Statements

Balance Sheets

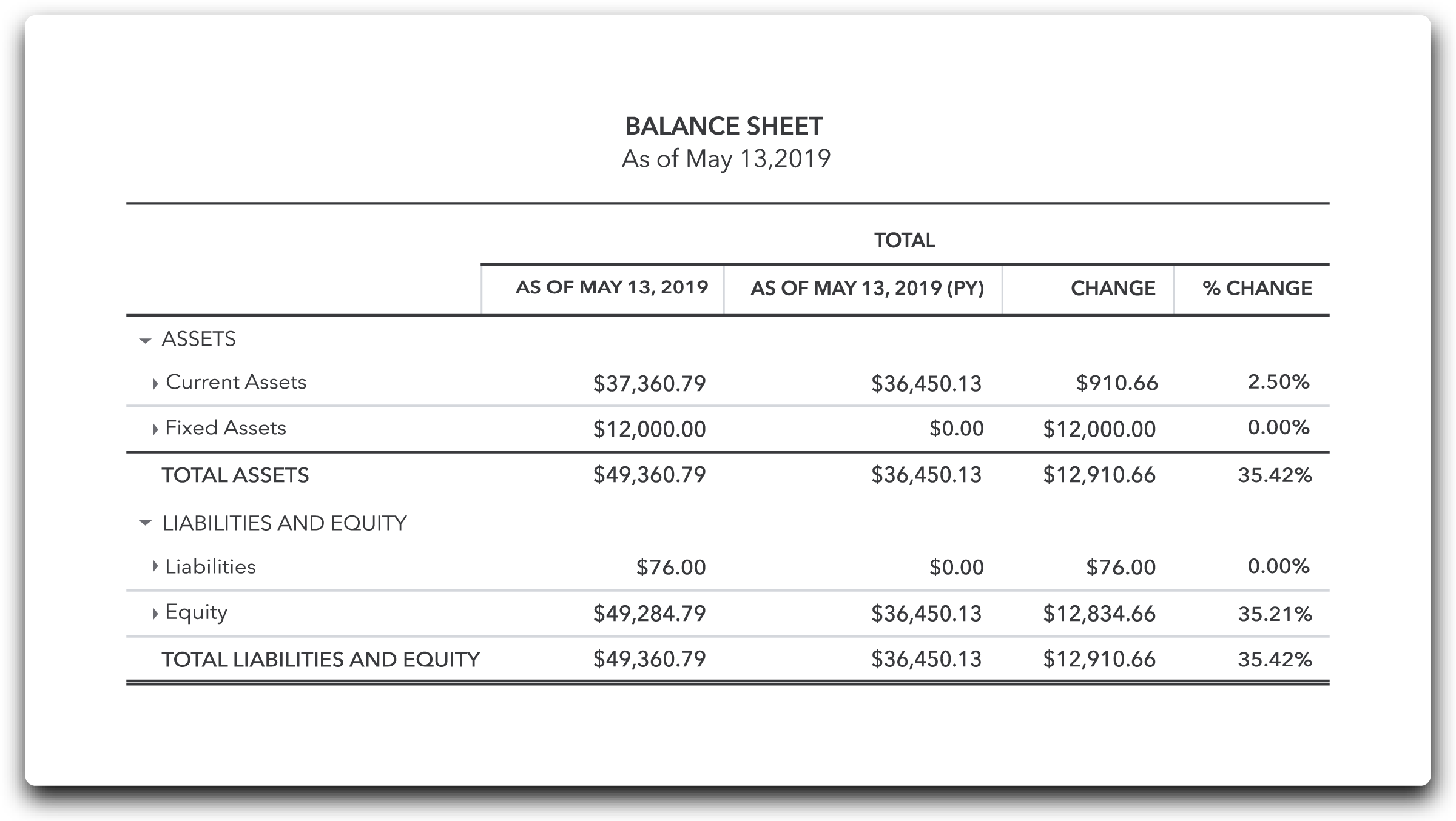

Source: QuickBooks

A balance sheet is like a snapshot of a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, which provides a clear overview of its financial standing. The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity.

Assets are resources owned by the company that have value, such as cash, accounts receivable, inventory, property, and equipment. Assets are usually divided into current assets, which can be easily converted to cash within a year, and non-current or fixed assets, which have a longer-term value.

Example: Let's say your small business has $50,000 in cash, $10,000 in accounts receivable, and $25,000 in inventory. Your total current assets would be $85,000. Suppose you also own property valued at $100,000 and equipment worth $20,000. In that case, your total non-current assets would be $120,000, making your overall assets equal to $205,000.

Liabilities represent the company's financial obligations or debts. Similar to assets, liabilities are classified into current liabilities, which are due within a year, and long-term liabilities, which have a repayment period exceeding one year.

Are you enjoying this blog?

To join our newsletter, text BLOG to (833) 779-2627.

Example: For your business, suppose you have a $5,000 short-term loan payable, $3,000 in accounts payable, and a $7,000 long-term loan. Your total current liabilities would be $8,000, and your long-term liabilities would be $7,000, amounting to a total of $15,000 in liabilities.

Equity is also known as net assets or owner's equity. It shows what's left of the company's assets after taking away all the debts - essentially, how much of the company's stuff belongs to the owner.

Example: Using the previous figures, your business's total equity would be calculated as $205,000 (total assets) minus $15,000 (total liabilities), resulting in $190,000.

Income Statements

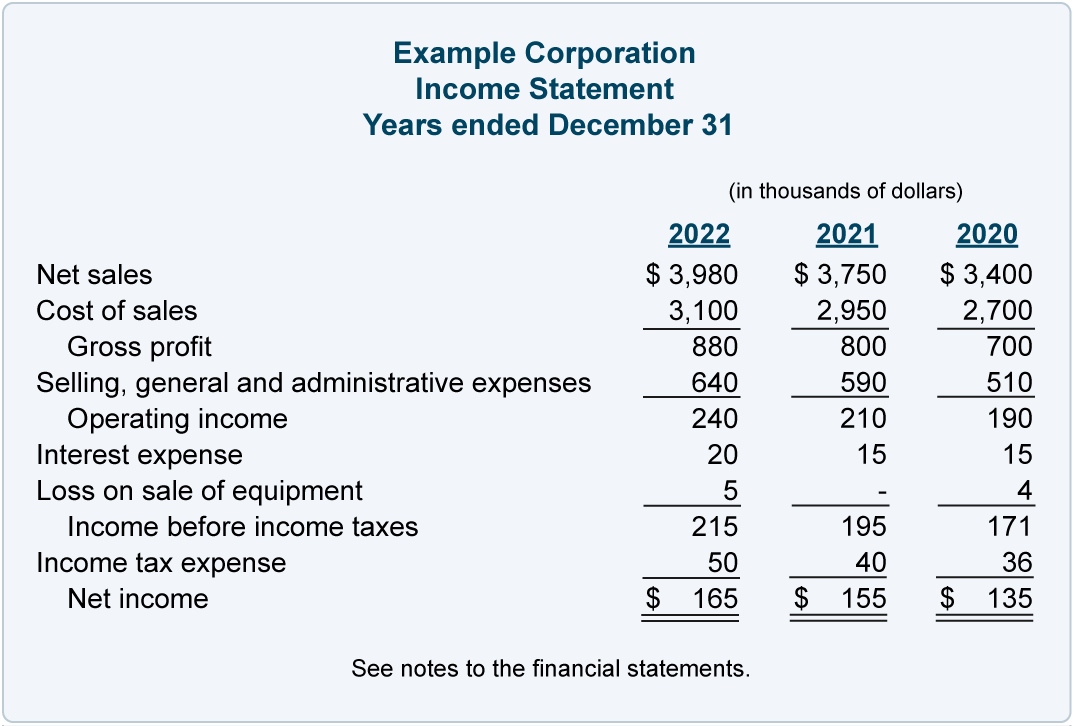

Source: Accounting Coach

The income statement, also known as the profit and loss statement, is a financial report that gives an overview of a company's revenues, expenses, and net income or loss over a specific period. This statement works to understand the profitability of a business and track its performance over time. The income statement is generally divided into three sections:

1. Revenue: All the money generated by the company through its primary business activities, such as product sales or services rendered, as well as any secondary sources like investments.

2. Expenses: All costs incurred while running the business, such as salaries, rent, utilities, marketing costs, and other operational expenditures. Expenses are often categorized into cost of goods sold (COGS), which is the direct costs of producing a product or service, and operating expenses, which are the indirect costs of running the business.

3. Net Income/Loss: This is the final result of subtracting expenses from revenue, showing whether the company has earned a profit or suffered a loss during the period in question.

Cash Flow Statements

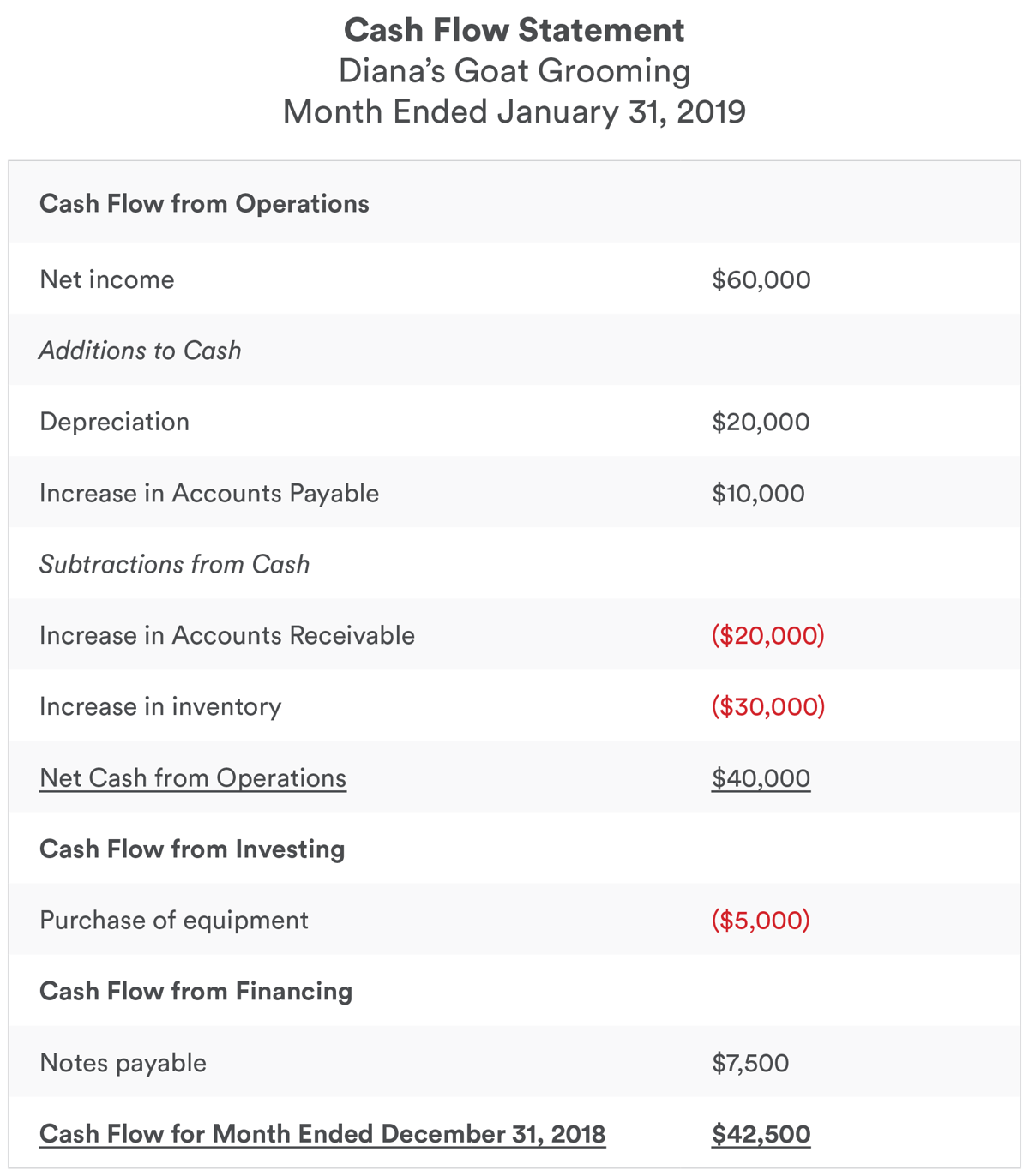

Source: Bench.co

The cash flow statement is an important financial report that tracks the flow of cash into and out of a business over a specific period. It shows how the company generates and uses cash for operations, helping business owners understand their liquidity and overall cash management. Cash flow statements are divided into three main sections:

1. Operating Activities: The cash flow generated by a company's core business operations, such as sales revenue and expenses associated with providing goods or services. It offers a look into how effective a company is at converting its net income into cash.

2. Investing Activities: Cash transactions related to investments, such as purchasing or selling equipment, property, or securities, so the business can grow and expand.

Example: Suppose your company purchases new equipment for $10,000 and sells an old machine for $3,000. In that case, the net cash flow from investing activities would be -$7,000 ($3,000 minus $10,000).

3. Financing Activities: This part of the cash flow statement reflects cash transactions involving the company's owners and those they owe money to, such as borrowing money, paying off loans, or dealing with company shares. This explains how a business is getting the money it needs to run and grow.

Example: If your small business receives a $15,000 loan and pays $2,000 towards an existing loan, the net cash flow from financing activities would be $13,000 ($15,000 minus $2,000).

Enhance Your Financial Health With the Right Tools

As an owner-operator managing the many aspects of your business, reliable and easy-to-use financial tools are something you should be taking advantage of. Choosing the appropriate financial statement creation tools and applications can make all the difference in driving success, growth, and sustainability for your business.

Using a combination of accounting software, invoicing and payment tools, and spreadsheet applications can serve to organize your financial data, maintain healthy cash flow, and optimize your overall financial health.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)