Recordatorios de Pago Tardío: Cómo Asegurarte de Que Te Paguen

Los recordatorios de pago tardío son clave cuando las facturas no se pagan. Aquí te mostramos cómo redactarlos de manera efectiva.

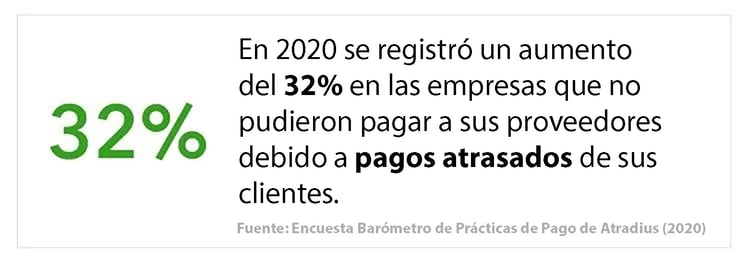

Como propietario de un pequeño negocio, confías en que tus clientes te realizarán sus pagos puntualmente después de completar un trabajo. Desafortunadamente, eso no siempre sucede. A veces, los clientes pueden no saldar las facturas a tiempo, incluso si proporcionas un servicio de primera calidad. Es inevitable.

Necesitarás enviar recordatorios de pago tardío si los clientes no te pagan a tiempo. Aunque hacer un seguimiento de los pagos atrasados puede parecer caminar en una cuerda floja, no tiene que ser desalentador. En esta guía, te proporcionaremos consejos útiles que puedes usar para solicitar pagos vencidos.

Ir a:

-

Consejos para Optimizar tus Recordatorios de Pagos Tardíos

-

1. Crea Múltiples Plantillas de Recordatorio de Pago para Diferentes Escenarios

-

2. Mantén un Tono Firme y Profesional sin ser Acusatorio

-

3. Siempre Incluye Detalles de Pago y Registros Relevantes

-

4. Trata de No Escalar la Situación, Pero Menciona Acción Legal si el Retraso es de Varios Días

-

5. Al Llegar a los 90 Días, No Tengas Miedo de Contratar una Agencia de Cobro Profesional

-

-

Elimina el Estrés de los Pagos Atrasados

Consejos para Optimizar tus Recordatorios de Pagos Tardíos

Fuente: QuickBooks and Atradius

Fuente: QuickBooks and Atradius

Al enviar recordatorios de pago tardío a los clientes, necesitarás ser cortés pero firme. Pero, ¿cómo puedes encontrar el equilibrio adecuado sin parecer demasiado dócil o excesivamente agresivo?

Si no estás seguro de cómo solicitar pagos vencidos a los clientes, aquí tienes cinco consejos útiles que puedes utilizar para optimizar tus recordatorios de pago tardío.

1. Crea Múltiples Plantillas de Recordatorio de Pago para Diferentes Escenarios

Al redactar un correo electrónico de recordatorio de pago tardío, no hay un correo electrónico de talla única adecuado para cada cliente moroso. Idealmente, tus correos electrónicos de pago vencido deberían variar dependiendo de cuánto tiempo ha pasado desde la fecha de vencimiento.

Por ejemplo, el tono que uses en un correo electrónico para una factura vencida hace dos semanas no debería ser idéntico al que uses en un correo electrónico para un pago con un mes de retraso.

Teniendo esto en cuenta, aquí tienes cinco plantillas de recordatorio de pago tardío para diferentes situaciones.

Una Semana Antes del Vencimiento del Pago

Algunos clientes pueden no hacer pagos a tiempo porque han olvidado la fecha de vencimiento de la factura. Hasta un 35% de las personas admiten haber perdido pagos con tarjeta de crédito porque se olvidaron de ellos. Lo mismo puede suceder con tu factura.

Por lo tanto, deberías enviar correos electrónicos de seguimiento a los clientes al menos una semana antes de la fecha de vencimiento de la factura.

Ten en cuenta que en esta etapa, el cliente no ha fallado en realizar el pago a tiempo, por lo que querrás utilizar un tono esperanzador en tu correo electrónico. Aquí tienes un ejemplo de correo electrónico:

Asunto: Seguimiento sobre la factura [número de referencia de la factura]

Mensaje:

Estimado/a [nombre del cliente],

Espero que se encuentres bien. Le envío este recordatorio de cortesía para informarle que el pago de la factura [número de referencia de la factura], enviada el [fecha en que se envió la factura], vence el [fecha de vencimiento de la factura].

Puede realizar su pago a través de [métodos de pago].

Adjunto encontrará una copia original de la factura. Si necesita asistencia, no dude en responder a este correo electrónico. Estaré encantado/a de ayudarle.

Atentamente,

[Tu nombre]

Este correo electrónico es efectivo porque es cortés, breve e informativo. Proporciona información necesaria como el número de referencia de la factura, los métodos de pago y la fecha de vencimiento para que el cliente mantenga el pago en mente.

El correo electrónico no confronta al cliente para que realice el pago porque aún no está vencido. Como resultado, puede hacer que el cliente esté más dispuesto a realizar el pago antes de tiempo.

El día de la Fecha de Vencimiento de Pago

Si recibiste el pago después de enviar el primer correo electrónico, ¡genial! Si no, es posible que necesites hacer un seguimiento con un correo electrónico de recordatorio de pago tardío en la fecha de vencimiento real.

Al igual que el primer correo electrónico, el correo electrónico que envíes en el día de la fecha de vencimiento no necesita ser confrontacional. En su lugar, debe ser un recordatorio amistoso y directo de que el pago está casi vencido. Aquí tienes un ejemplo de plantilla de correo electrónico que puedes usar para brindar un servicio eficiente:

Asunto: La factura [número de referencia de la factura] vence hoy

Mensaje:

Hola [nombre del cliente],

Este es un recordatorio de cortesía de que el pago de la factura [número de referencia de la factura], enviada el [fecha de envío de la factura], vence hoy.

Puede realizar su pago a través de [métodos de pago].

He adjuntado una copia de la factura con los detalles de pago. Si tiene alguna pregunta sobre el pago, no dude en ponerse en contacto. Estaré encantado de aclarar cualquier duda.

Saludos cordiales,

[Tu nombre]

Este correo electrónico es efectivo porque va directo al grano y es conciso. También utiliza negritas para enfatizar la frase "vence hoy" para crear un sentido de urgencia.

Una Semana Después de la Fecha de Vencimiento

Desafortunadamente, algunos clientes no te pagarán incluso después de enviar el segundo correo de seguimiento. Aunque puedas querer enviar un correo con un tono más severo o dejar de hacer seguimiento, no hagas ninguna de estas cosas.

En su lugar, utiliza un enfoque más directo en tu tercer correo de recordatorio de pago tardío. En esta etapa, también puedes querer asegurarles a los clientes que sus cuentas siguen en buen estado y reforzar la confianza en tu negocio. Aquí tienes una plantilla de correo electrónico de recordatorio de pago efectiva:

Asunto: La factura [número de referencia de la factura] tiene una semana de retraso

Mensaje:

Hola [nombre del cliente],

Nuestros registros muestran que no hemos recibido su pago para la factura [número de referencia de la factura].

Sin embargo, no se preocupe. Aún no has incurrido en ninguna tarifa por retraso.

Todavía puede realizar el pago inicial a través de [métodos de pago].

Por favor, hazme saber si necesita ayuda para saldar el pago.

He adjuntado una copia de la factura por si la ha extraviado.

Saludos cordiales,

[Tu nombre]

A diferencia de los dos primeros correos electrónicos, este utiliza un enfoque más directo. Al asegurar a los clientes que aún no han incurrido en tarifas por retraso, el correo también hace que los clientes sientan que la deuda es manejable mientras insinúa que podría escalar. Como resultado, puede convencer a los clientes de saldar la factura antes de que incurran en tarifas adicionales y mejorar la relación comercial con tu negocio.

Dos Semanas Después de la Fecha de Vencimiento

Si el cliente no ha pagado dos semanas después de la fecha de vencimiento de la factura, podría ser una señal de que estás tratando con un cliente moroso. Por lo tanto, necesitarás usar un tono más firme en tu carta de recordatorio de pago tardío. Aquí tienes una plantilla de recordatorio de pago atrasado con un tono firme pero profesional:

Asunto: La factura [número de referencia de la factura] tiene dos semanas de retraso

Mensaje:

Hola [nombre del cliente],

Le escribo para recordarle que no hemos recibido su pago para la factura número [número de referencia de la factura]. La factura ya tiene dos semanas de retraso.

Si tiene alguna pregunta o inquietud respecto al pago, por favor, póngase en contacto. De lo contrario, realice el pago del monto pendiente lo antes posible para evitar tarifas por retraso.

Puede realizar el pago a través de [métodos de pago].

Como recordatorio, se aplicarán penalidades después de [X] semanas de retraso. Espero su pronta respuesta.

Saludos cordiales,

[Tu nombre]

Necesitas usar un tono más firme en este correo electrónico que en los anteriores. Sin embargo, tu enfoque no debe parecer grosero.

En su lugar, puedes utilizar tácticas como recordar a los clientes que incurrirán en penalidades por retraso o en cargos por interés si no saldan la factura. Alternativamente, podrías advertir a los clientes sobre la posible interrupción del servicio si aún estás brindando un servicio y no han pagado.

Un Mes Después de la Fecha de Vencimiento

Si el cliente aún no ha pagado después de recibir tus correos electrónicos anteriores, deja de enviar recordatorios por un tiempo. Aunque esto puede sonar contraintuitivo, deberías dejar de enviar correos electrónicos de recordatorio para evitar que los clientes morosos se sientan saturados.

Después de haber esperado un poco, envía otro correo electrónico de recordatorio un mes después de la fecha de vencimiento de la factura. Aquí tienes una plantilla que puedes usar:

Asunto: Recordatorio Final: La factura [número de referencia de la factura] tiene un mes de retraso

Mensaje:

Aún no hemos recibido su pago para la factura número [número de referencia de la factura]. La factura tiene un mes de retraso, y este correo electrónico es su recordatorio final.

Como se estipula en los términos de pago, ahora ha incurrido en una penalidad por retraso.

He adjuntado una factura con el monto pendiente y los detalles de pago para su referencia.

Por favor, póngase en contacto si tiene alguna consulta respecto a este pago. De lo contrario, salde la factura pendiente lo antes posible.

Saludos cordiales,

[Tu nombre]

Puedes usar un tono mucho más severo en este correo que en los anteriores. También puedes utilizar ultimátums para captar la atención del cliente. Por ejemplo, en la plantilla anterior, usamos "recordatorio final."

Además, también puedes recordar a los clientes sobre los términos de pago para alentarlos a saldar las facturas atrasadas antes de que las tarifas por retraso se acumulen.

2. Mantén un Tono Firme y Profesional sin ser Acusatorio

Tratar con clientes que no realizan pagos a tiempo puede ser frustrante para cualquier negocio. Sin embargo, tus correos electrónicos de recordatorio no deben parecer acusatorios. Deben mantener un tono cortés y profesional en todo momento.

Dicho esto, aquí tienes algunas mejores prácticas a seguir al redactar tus correos electrónicos:

- Utiliza una declaración de apertura amigable: Comienza tus correos electrónicos con frases como "Espero que este correo te encuentre bien" o "Espero que estés bien". Aunque estas declaraciones pueden parecer triviales, pueden ayudar a comenzar con buen pie.

- Evita declaraciones en segunda persona: Declaraciones como "Tienes que pagarnos antes del 14 de septiembre" pueden parecer acusatorias. En su lugar, di "El pago vence el 14 de septiembre."

- Usa un lenguaje empático: Algunos clientes tienen agendas ocupadas. Como resultado, pueden olvidar pagarte debido a otras prioridades. Por lo tanto, considera usar un tono empático en tus correos electrónicos. Por ejemplo, podrías usar frases como "Sé que tienes un horario ajetreado" o "Sé que estás muy ocupado" en tus correos.

- Ofrece ayuda: Algunos clientes pueden tener dificultades genuinas para realizar pagos. Pregunta si puedes proporcionar asistencia o aclarar algo en tu conclusión.

3. Siempre Incluye Detalles de Pago y Registros Relevantes

Al enviar correos electrónicos de recordatorio de pago tardío a los clientes, siempre debes incluir información y documentación relevante para que el proceso de pago sea lo más fluido posible.

Aquí tienes algunos detalles y registros clave que debes incluir en tus correos electrónicos:

Factura Original y Factura Atrasada

En 2019, los clientes recibieron un promedio de 121 correos electrónicos diarios, y ese número probablemente aumenta cada año. - Campaign Monitor

Al igual que tú, los clientes no quieren buscar entre todos estos correos electrónicos para encontrar tu factura y es menos probable que te paguen a tiempo. Facilita su vida adjuntando las facturas a tus correos de recordatorio. Alternativamente, proporciona enlaces a facturas en línea si estás utilizando software de facturación.

Recordatorio Amigable de los Términos de Pago

Si los términos de pago no están claros, los clientes pueden no pagarte puntualmente. Peor aún, los términos de pago poco claros podrían llevar a pagos erróneos y resultar costosos para tu negocio.

Para evitar estas situaciones, asegúrate de incluir los siguientes términos de pago en los correos de recordatorio a los clientes:

- La fecha de emisión de la factura

- La fecha de vencimiento de la factura

- El monto pendiente

Cargos por Pagos Tardíos

Recuerda incluir las advertencias de cargos por pago tardío en tus correos de recordatorio a clientes que no te han pagado después de la fecha de vencimiento. Sin embargo, solo puedes hacerlo si un cargo por pago tardío está incluido en el contrato original. Fuente: Handle

Fuente: Handle

Opciones de Pago

Incluye todos los métodos de pago que ofreces en tu correo de recordatorio a los clientes. Si es posible, proporciona a tus clientes opciones de pago flexibles como efectivo, cheques y pagos en línea.

Ofrecer muchas opciones de pago puede aumentar tus posibilidades de recibir el pago más rápido.

4. Trata de No Escalar la Situación, Pero Menciona Acción Legal si el Retraso es de Varios Días

Si estás tratando con clientes que no han pagado sus facturas pendientes y no responden a los correos electrónicos mucho después de la fecha de vencimiento, deberías considerar mencionar la posibilidad de tomar acciones legales.

La acción legal puede motivar incluso a los clientes más obstinados a saldar sus facturas impagas, ya que querrán evitar problemas legales, por lo que puede ser una opción a considerar. Sin embargo, la acción legal puede ser costosa, consumir mucho tiempo y ser emocionalmente agotadora, por lo que puede ser mejor agotar otras opciones antes de recurrir a medidas legales.

5. Al Llegar a los 90 Días, No Tengas Miedo de Contratar una Agencia de Cobro Profesional

Si el cliente sigue sin responder después de mencionar la posibilidad de acción legal, no dudes en contratar una agencia de cobro profesional. Transferir los detalles del cliente a una agencia de cobro puede afectar negativamente el puntaje crediticio del cliente, lo que podría motivarlo a saldar la factura pendiente. Fuente: QuickBooks

Fuente: QuickBooks

Ten en cuenta que contratar una agencia de cobro sin duda romperá tu relación con el cliente, por lo que solo debes considerarlo como un último recurso.

Elimina el Estrés de los Pagos Atrasados

Casi el 50% de las facturas de las empresas en EE.UU. se volverán atrasadas. Esto significa que probablemente necesitarás hacer seguimiento a los pagos tardíos si aún no lo haces.

Hacer seguimiento de los pagos atrasados no es una tarea fácil. Hacerlo con numerosos pagos tardíos puede resultar aún más desafiante, especialmente si te falta tiempo. Pero no tiene por qué ser así.

Con GoSite, puedes programar y enviar recordatorios de pagos atrasados a los clientes en intervalos específicos para que tus clientes mantengan tus facturas en mente. También puedes generar automáticamente facturas detalladas y enviarlas a los clientes con solo un clic. ¡Prueba GoSite GRATIS hoy mismo!

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)