Fast Payments

We've made some changes here at GoSite!

Click here to visit an updated version of this page.

Contactless Payment App for Small Business

Get Paid Faster & More Often

with GoSite’s Payment App for Small Business

Instant Payments & Automatic Reminders

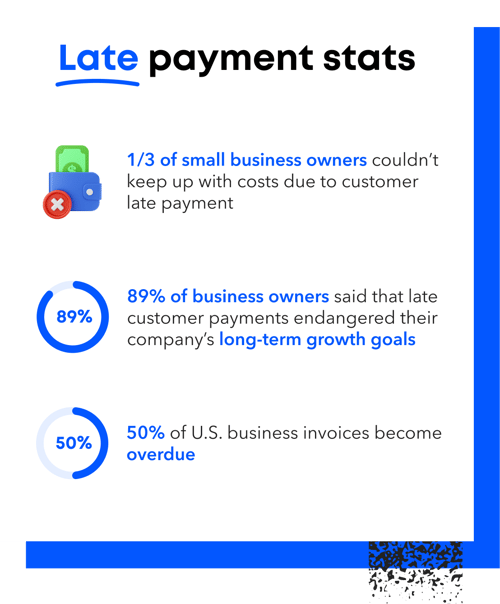

Most small businesses today struggle with cash flow and customer late payments.

But with GoSite, it's much easier for you to request and collect payments. More importantly, it's even more simple for customers to pay you.

With GoSite Payments, You Can…

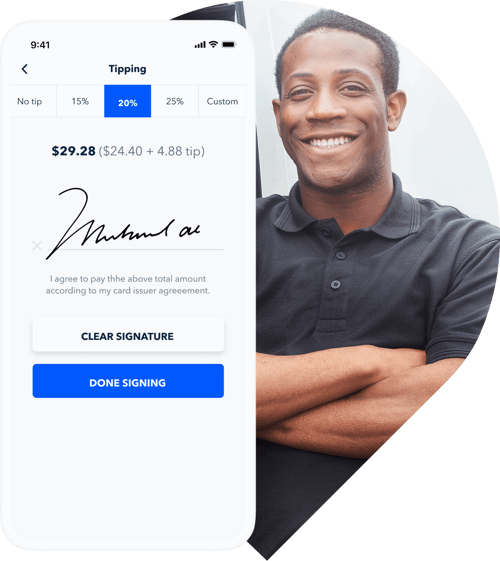

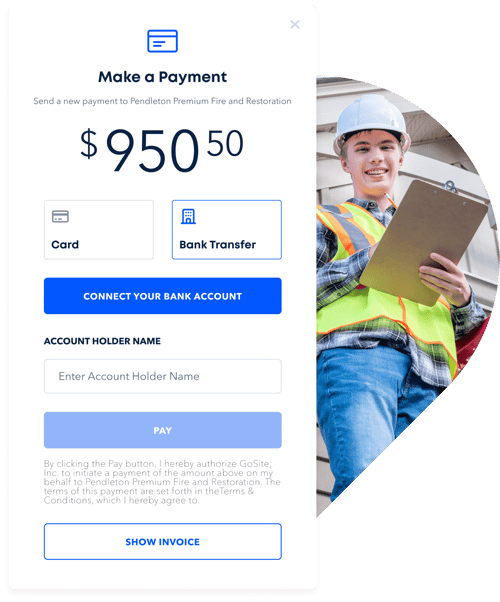

01 Make It Easy for Customers to Pay

Get Paid Online Instantly

Make it easy for your customers to pay you from anywhere.

Increase revenue by offering online payments. Offering reliable, secure contactless payment options puts more money in your pocket faster.

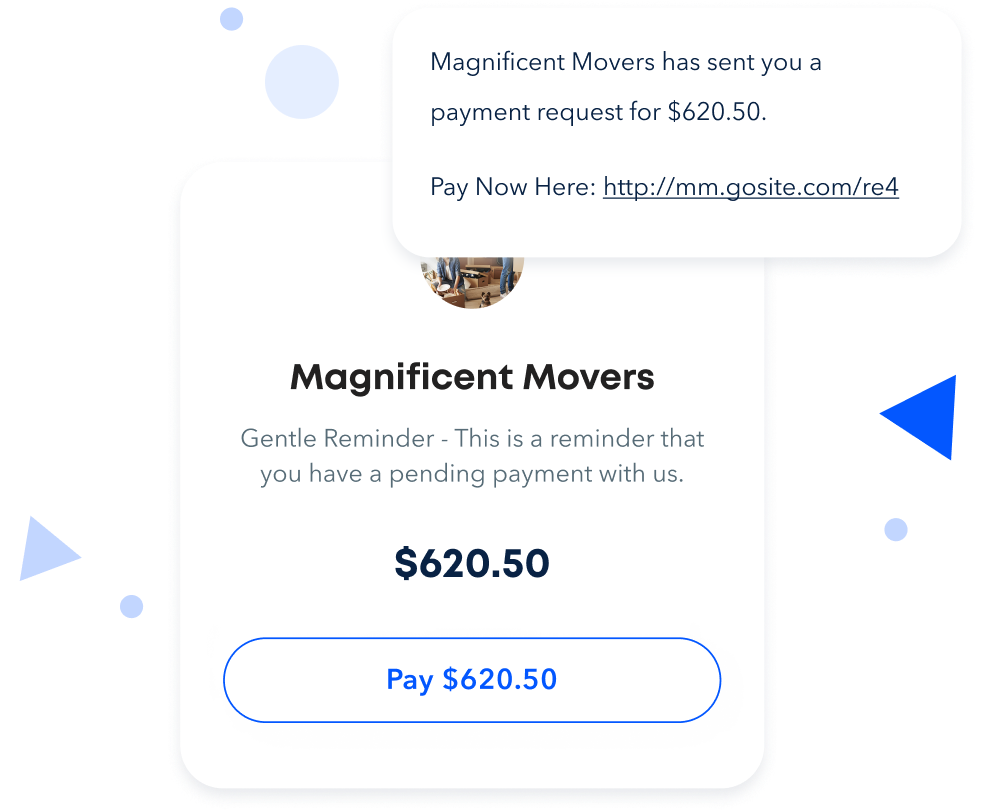

02 Reduce Late Payments

Reduce Late Payments With Automatic Reminders

Most late payments occur because customers simply forgot. GoSite comes equipped with automated reminders for you to set up in seconds.

Following up on unpaid invoices is a pain, but it doesn’t have to be. Launching professional-looking payment reminders in GoSite is a piece of cake.

03 No More Holding Accounts

Deposits Directly into Your Checking Account

With cash apps and accounting software, placing your sales into a holding account is the norm.

But GoSite lets you connect your business bank account and see your sales process directly into your account. That means more money at your fingertips faster.

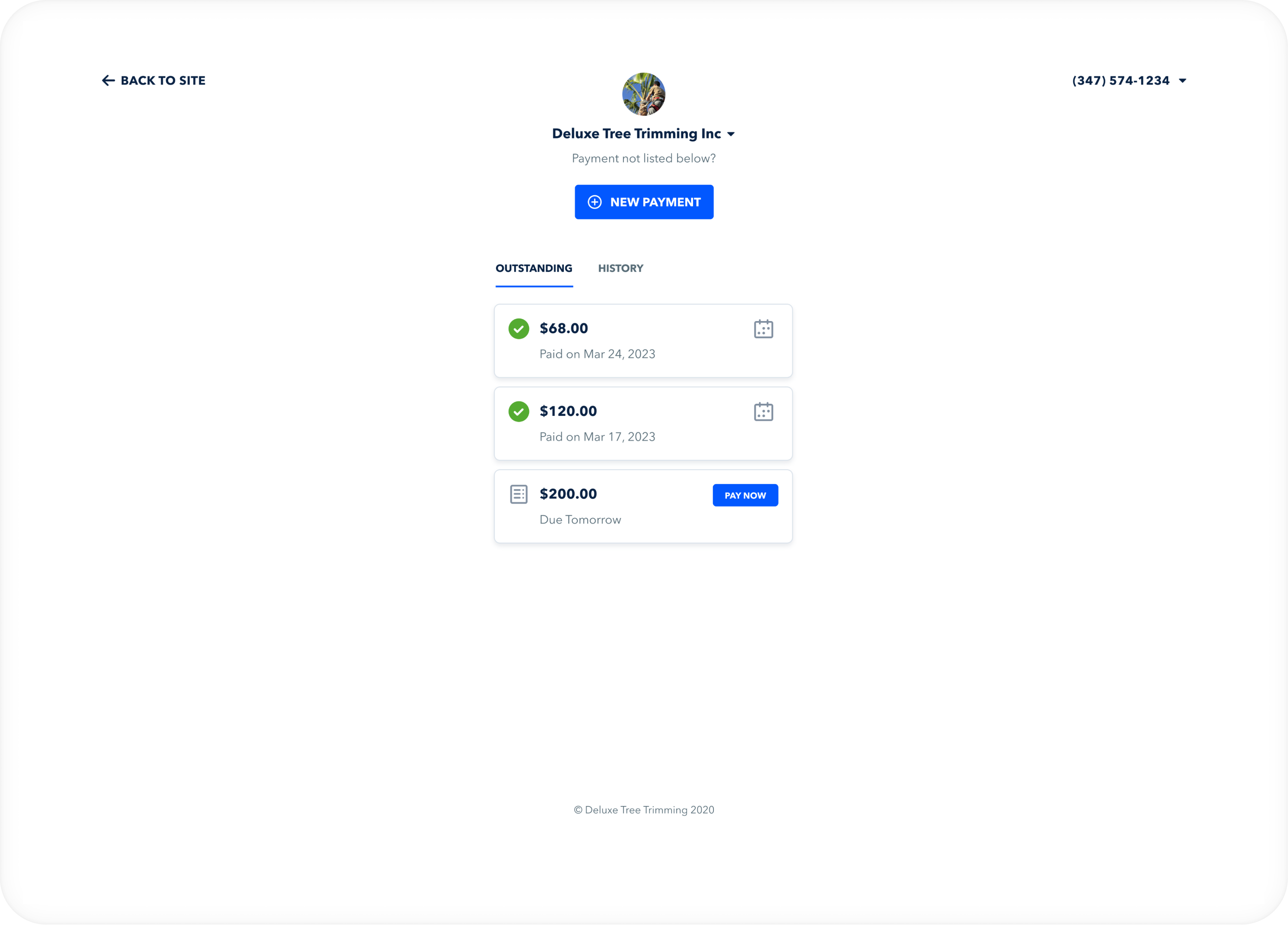

04 Customers Access Their Own Receipts

Client Portal

Did you know that GoSite also offers your customers their own portal where they can access payment requests, statuses, and receipts?

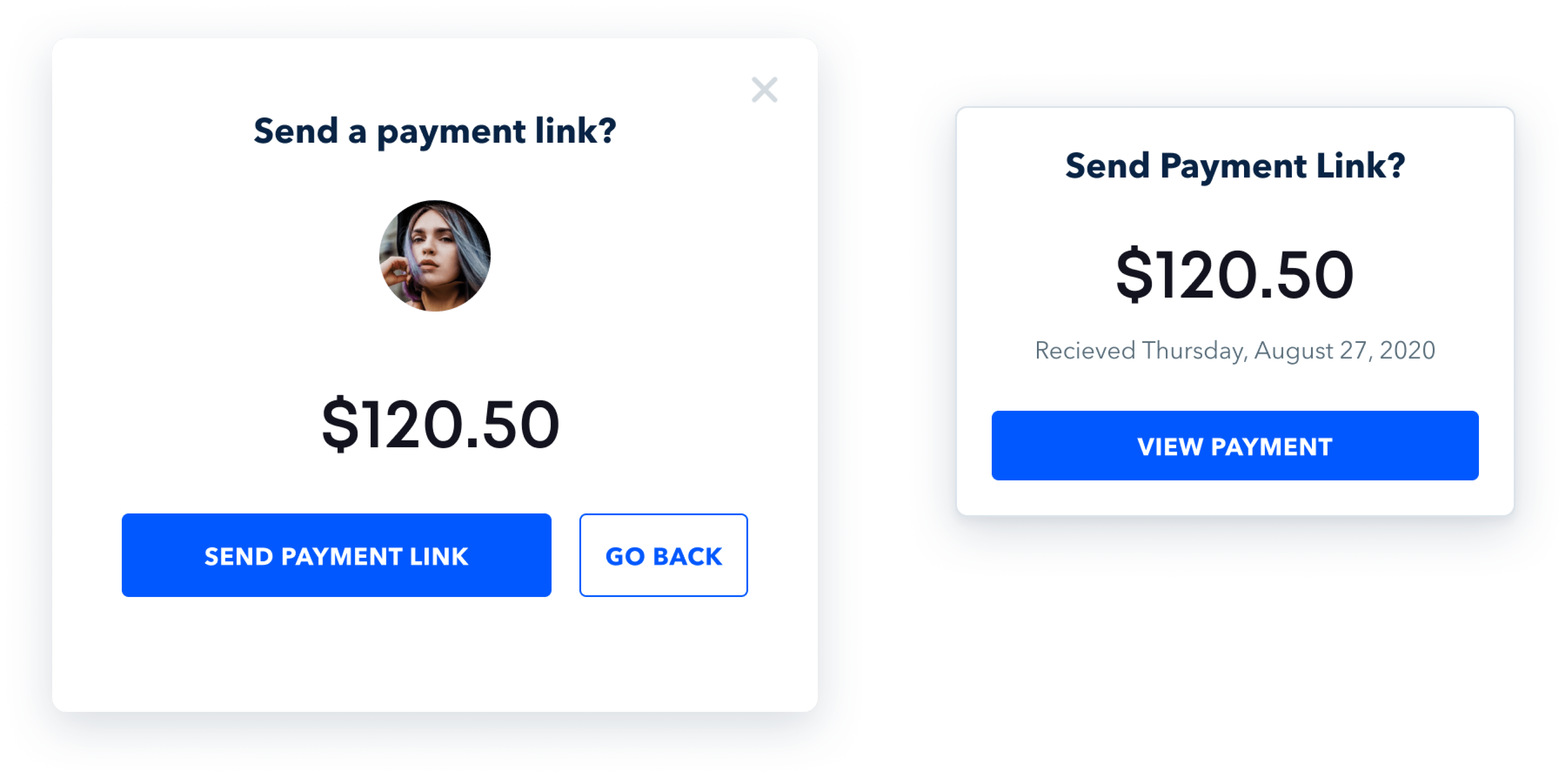

When you send a payment link, all your customers have to do is enter their phone number. From there, they can see every payment request and access receipts for completed payments.

05 Integrate With All GoSite Tools

Integrate With All GoSite Tools

With GoSite, you can connect Payments with your Bookings, Invoicing, Messenger, Reviews, and small business CRM.

Additionally, you can add payment features into your GoSite website with just a few clicks.

The GoSite app is the payments app you need to scale your small business the right way.

With GoSite Payments, you can work smarter, not harder.

-

Number of customer late payments cut in half

-

30-50% more scheduled service appointments

-

150% boost in sales

-

1000% more love for what you do

GoSite helps owner-operators like you…

-

Offer multiple contactless payment options, including credit/debit cards & secure bank transfers

-

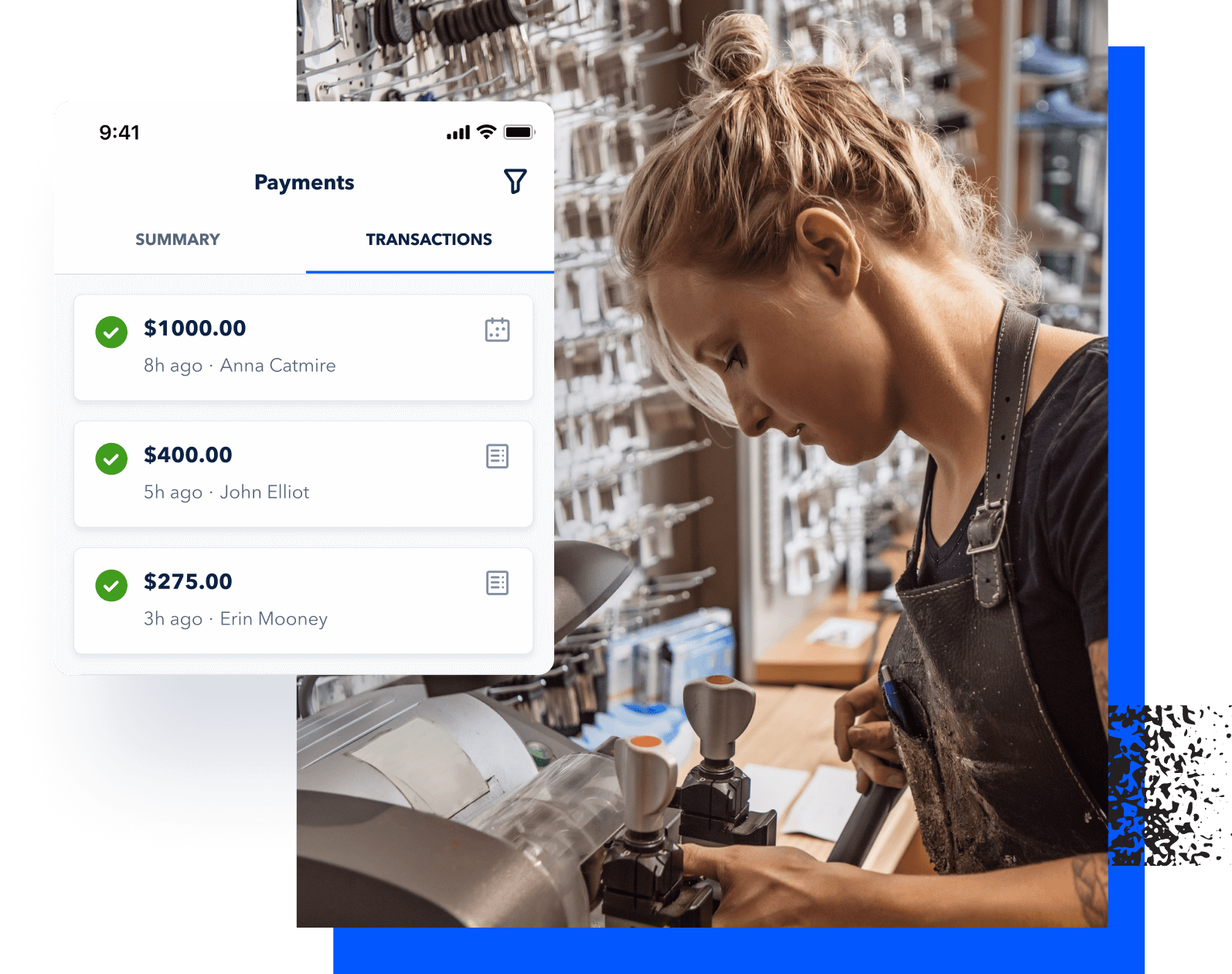

Generate quick payment links, take payments in person & recurring payments

-

Connect your QuickBooks Online account

-

Automate reminders & track payment statuses in real time

-

And more!

No Technology Experience Required

And best of all, you can set up your GoSite account instantly without spending weeks figuring out how it works.

Send a link to a customer’s email, phone, or instant messenger, and they pay right away. Now, you can focus on what you do best without having to chase late payments or deal with customer collections.

GoSite is the payment app for small businesses that will save you hours of time and help you get paid faster.

Talk to an Expert

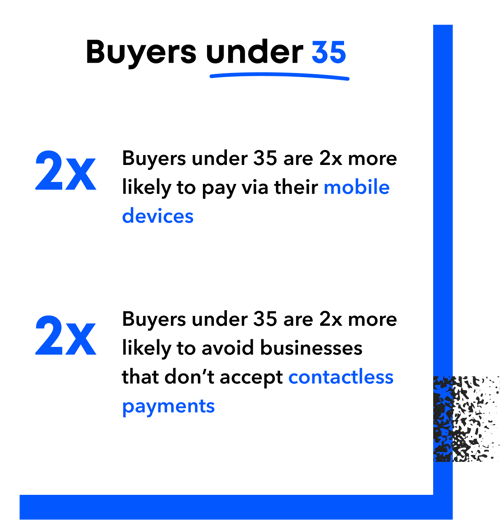

Customers Prefer Contactless Payments

About 80% of customers around the world prefer to use a contactless payment method for small businesses.

Source: Mastercard

People today want convenience. And when your business offers secure mobile payment options, customers don’t just pay on time, they become more loyal.

In today’s mobile buying environment...

Customers expect to be able to complete transactions from their devices anytime and anywhere. Peer-to-peer cash apps are expensive, unsustainable solutions for today’s owner-operators.

You need a payment app for small businesses that is secure, professional, and able to deposit funds directly into your bank account.

Hassle-free Payments for You & Your Customers

Inspire trust and build future business with the best payment option for small business owners.

The simpler you make it for customers to pay you, the more likely they are to trust you and employ your services again in the future.

With this much convenience, customers will love doing business with you.

-1.png?width=800&height=504&name=MKT-581%20(Updated)-1.png)

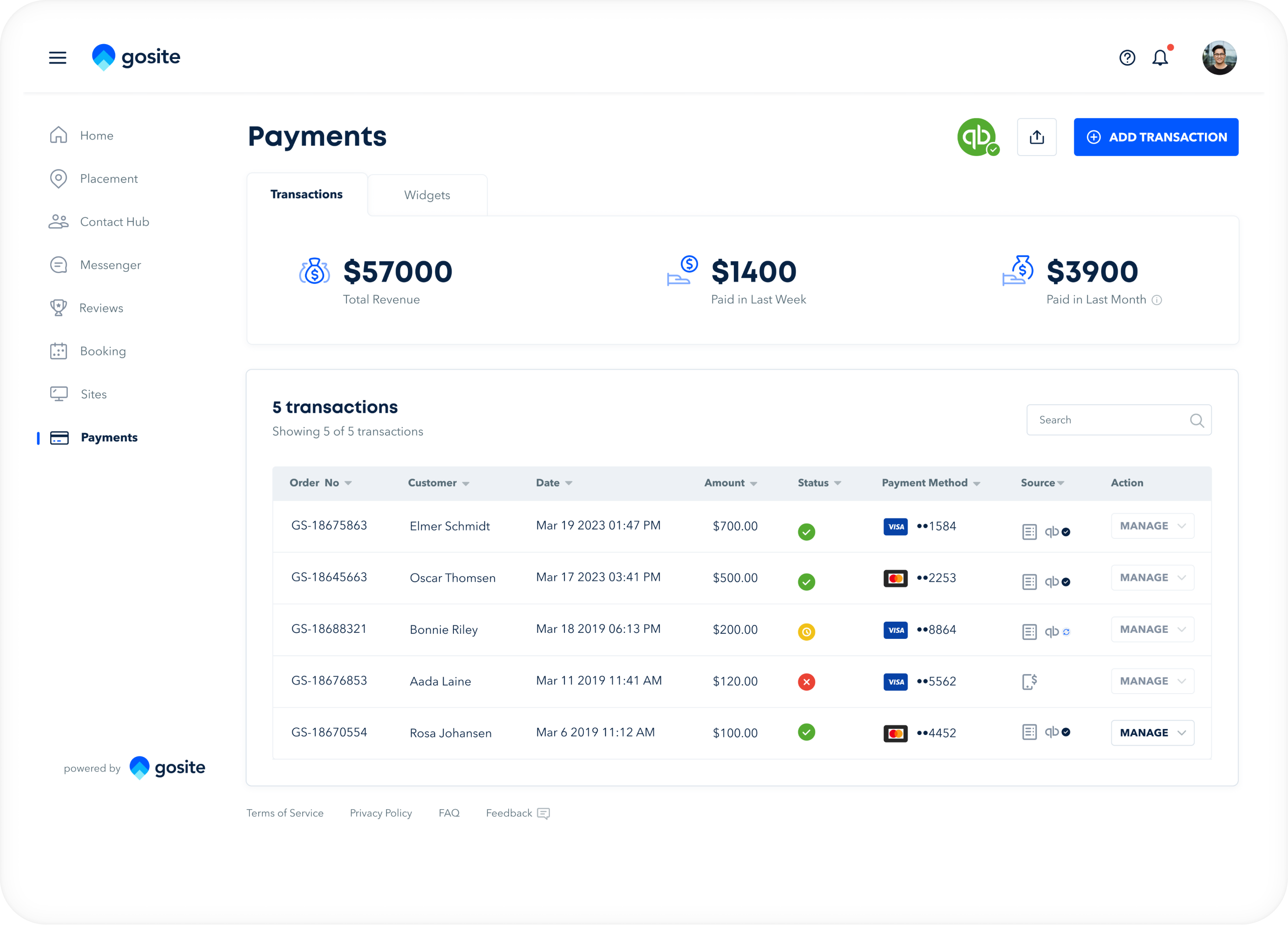

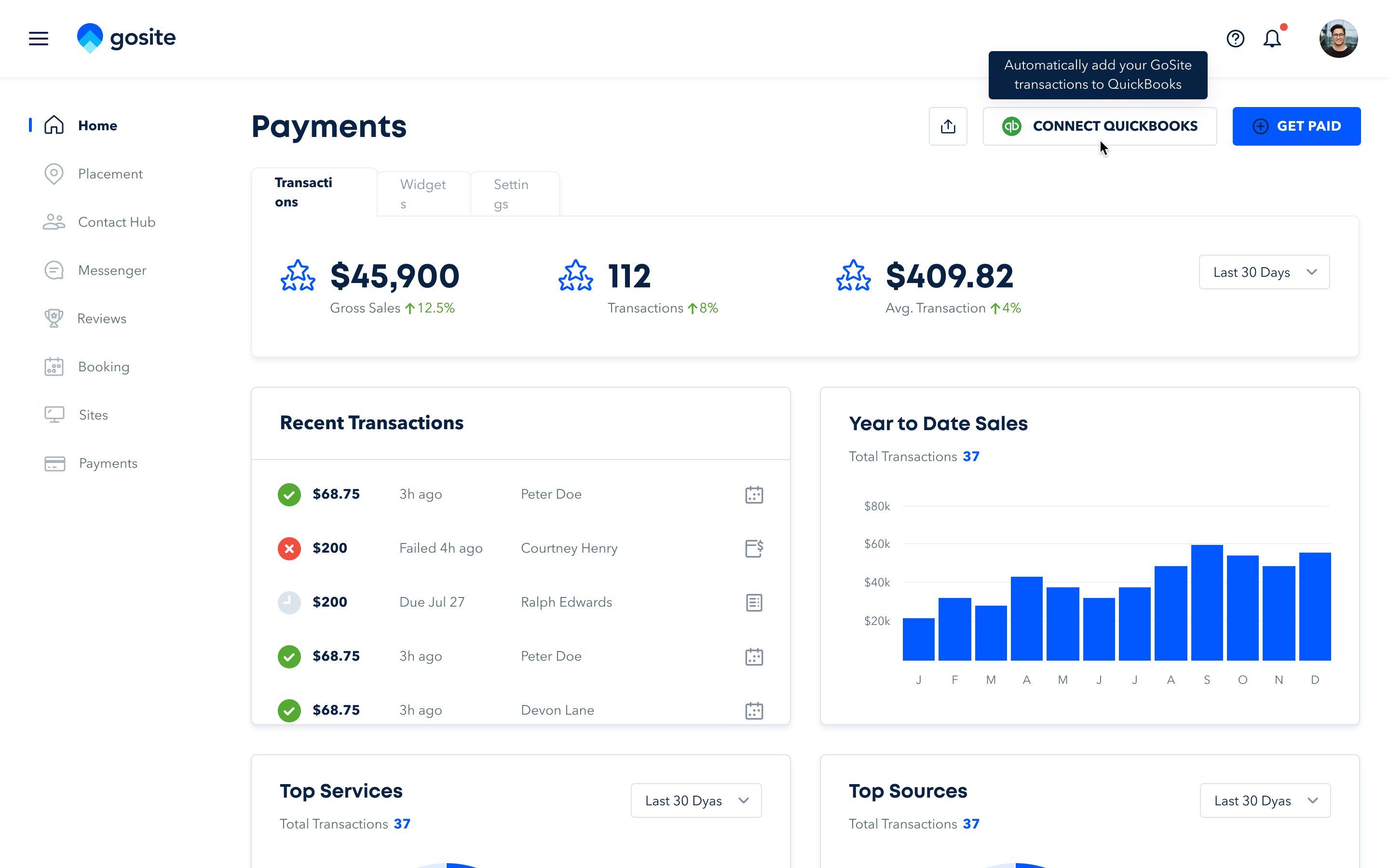

GoSite is a leading digital payments software that integrates with QuickBooks, Stripe, and accompanies a full suite of digital features to help you grow your business.

GoSite payment solutions for business owners makes your life better.

Take the stress out of bookkeeping, invoicing, and asking for payments.

Create, send, and track all of your GoSite invoices and payment requests online in one place, while also offering secure payment links for faster payments.

Easy Payments & Improved Cash Flow Go Hand-in-Hand

- 60% of small businesses struggle with cash flow and accounts for 80% of business closures.

- Mobile-friendly invoices increase your chances of getting paid immediately by 300%.

- 58% of buyers regularly use their mobile phones to pay bills.

- 9 out of 10 business owners say late payments threaten their growth.

Sources: SBA, Entrepreneur, QuickBooks, Businesswire

How Small Business Owners Thrive in the Digital Age

Owner-operator + the Right Technology

- 84% of small business owners who embrace technology experience a significant increase in sales.

- 88% of owner-operators experience greater joy and satisfaction in their work after adopting the right technology.

- 87% of small businesses that onboard technology are able to grow regardless of economic conditions.

Source: U.S. Chamber of Commerce

GoSite is a leading digital payments software that integrates with QuickBooks, Stripe, and accompanies a full suite of digital features to help you grow your business.

%20apps.png?width=500&height=604&name=Why%20business%20owners%20should%20avoid%20using%20cash%20(P2P)%20apps.png)

What’s the Problem with Using Venmo for Your Small Business?

Paying a service provider via Venmo, Cash App, PayPal, Kik, or another peer-to-peer cash app is as easy as tapping your phone's screen. Most U.S. customers are likely to have a peer-to-peer payment app right on their smartphones.

It appears to be the ideal solution – which is why many owner-operators use them without thinking twice. It’s cash-free, convenient, and easily accessible on any device.

But there’s a catch, and the risks could have severe consequences for your business.

Risks of Using Venmo, PayPal & Other Cash Apps

For Small Business Payments

-

Consumer payment apps aren’t fully secure for you or your customers.

Venmo’s policies make it clear that transactions must be set to private, otherwise they might be available to anyone on the internet. Also, it's worth noting that you can search for other users and their purchase history on P2P cash apps.

-

Consumer payment apps are prone to fraud, scams, and human error.

A LendingTree survey revealed that over 20% of respondents sent money to the wrong person through a cash app, and if they used the app multiple times a week, the percentage jumped to over 40%. And on most of these apps, there is no process for customers to get their money back.

-

Business transactions on P2P apps often undergo radical scrutiny that results in long holds on your funds.

Both PayPal and Venmo can hold funds for up to 21 days, while Cash App will place holds on certain transactions for up to 10 days. PayPal may place a hold even longer depending on the situation.

-

Many consumer payment apps don’t even allow business transactions (or strongly discourage the practice).

Venmo explicitly declares that you cannot use it for business transactions unless it is authorized by Venmo, and warns of the dangers of transactions in which two people who don’t know each other exchange money.

-

Balances in cash app holding accounts are not FDIC-insured.

Financial institutions and banks are required by law to have deposit insurance (known as FDIC), which protects your money in case of an institutional failure. Peer-to-peer apps are not held to the same standard and rarely (if ever) offer this coverage.

Click here for more information about the dangers of using Venmo and other cash apps.

A Secure, Easy Payment Solution That Integrates with QuickBooks & Stripe

GoSite offers you the convenience and ease-of-use of the consumer cash app with all the professionalism of a small business payment solution. Payment links you send let customers pay instantly wherever they are from the palm of their hand.

Any payment customers make (from debit card, credit card, or bank transfer) are 100% secure, fast, and processed directly to your business bank account.

GoSite + Stripe

Stripe is a global bank transfer solution for businesses of every size. Their affordable, secure transfer payments give your customers more flexibility and allow you to set up one-time or recurring payments, as needed.

GoSite + QuickBooks

QuickBooks is the leading accounting software platform for small businesses. By connecting your QuickBooks account to GoSite, you can track all your contacts and automatically sync every customer transaction.

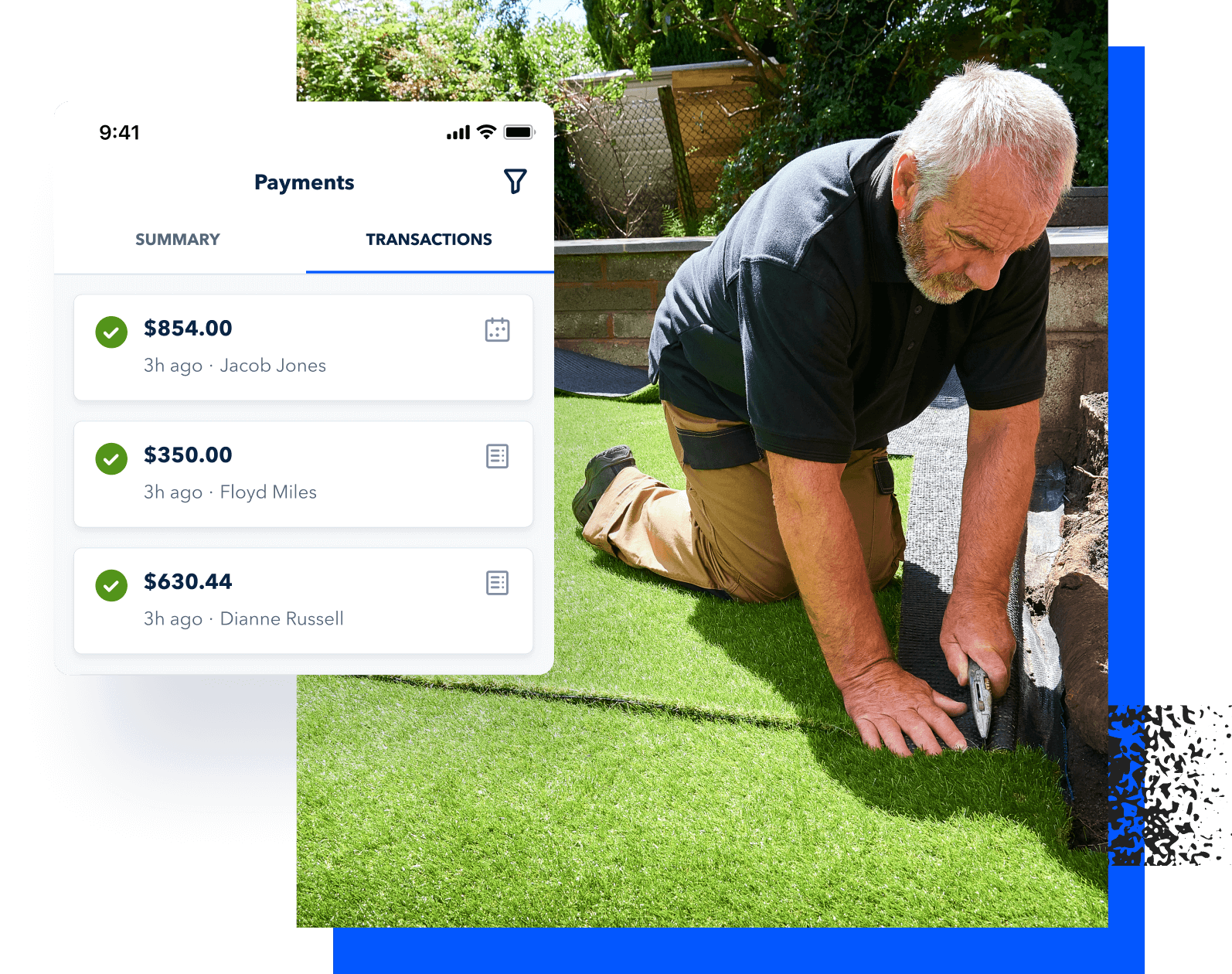

GoSite Payments, Plus Mobile Invoicing

As a professional online payment system for small business owner-operators, GoSite also lets you easily generate sharp-looking invoices from the palm of your hand.

Using our robust business payment solution, you have the option to send payment links or detailed invoices (along with a quick payment link) – whichever helps you boost your cash flow and reduce customer late payments. All of your receivables are trackable in real-time in the GoSite app.

Wanna send payment or invoice reminders? No problem. GoSite’s intuitive and easy-to-use online payment platform gives you all the tools you need to make sure your customers pay you promptly.

GoSite is a trusted leader among the best payment options for small businesses today.

Winter 2023 Awards

Winter 2023 Awards

⭐ Best in Support ⭐ Best in service ⭐ Best in class

Frequently Asked Questions

Can my customers make recurring payments?

100%. GoSite partners with Stripe so that customers can make one-time or recurring payments through bank transfer. Having the flexibility to receive monthly recurring payments will open up new possibilities, making it easier to adapt the sales process to the needs of your buyers.

Can customers set up their own recurring payments?

The Gosite-Stripe partnership gives you the ability to set up recurring payments for customers who prefer to pay from their bank account on a regular basis. At this time, GoSite does not allow customers to set up their own recurring payments.

Can I take payments in person?

Absolutely. Gosite’s online payment services for small businesses allow you to take payment in person through the app or on the phone. All you'll need is the customer's credit card information.

When do card processing fees take place?

When funds deposit into your account, they will be deposited with the fees already deducted from the total amount. You can set up credit card charges in your items list to charge this fee to clients using credit cards. This way, you can accept all of the most popular credit cards and avoid covering the cost of payment processing fees.

What happens in the event of a chargeback?

Chargebacks do happen from time to time. When this occurs, the dispute is between the customer’s bank (or credit card company) and the merchant processor. To reduce the risk of chargebacks, it’s critical that you maintain well-crafted invoices, communication records, and transaction records.

The GoSite payment app for small business integrates with Messages, Payments, Invoices, and your QuickBooks online account so that you can easily access these records in the event of a customer chargeback.

Have more questions?

Ready to see how GoSite can support your business needs? Check out GoSite’s Knowledge Base for more information on how the Booking tool works.